It is very easy to get a personal loan from Mashreq Bank. As an existing customer, you can avail this loan online through the quickest and fastest process. By applying online for this loan in just a few clicks, the loan can be approved in 5 minutes.

In this post we will give you detailed information about Mashreq Bank Personal Loan for Existing Customers, so stay with us here till the end.

Mashreq Bank Personal Loan for Existing Customers Details

If you are an existing customer of Mashreq Bank, then you can get a loan up to 20 times your salary or a maximum of one million dirhams from here. This loan comes with many features such as low interest on the loan, first installment can be paid in 90 days with no interest to be paid, instant online approval.

Apart from this, you can use this loan to fulfill your various tasks like for studies, for traveling somewhere, for decorating and beautifying the house, for paying medical bills. To avail this loan, it is necessary to transfer your salary to Mashreq bank.

Mashreq Bank Personal Loan for Existing Customers Loan Overview

Online process is available to apply Mashreq Bank Loan, which is convenient for existing customers. This loan is also suitable for those who are already customers of Mashreq Bank and need additional financial support.

Complete information about this loan is given in the table below which is as follows:

| Feature | Details |

|---|---|

| Bank Name | Mashreq Bank |

| Loan Type | Personal Loan |

| Categories | Unsecured |

| Loan Amount | ● Up to 20 times your salary, ● Maximum AED 1 million |

| Interest Rates | ● For Expatriates: 5.99% to 31.99% ● For Emiratis: 5.99% to 12.99% |

| 1st EMI Deferral | Up to 90 days |

| Processing Fee | 1.05% of the loan amount |

| Early Settlement Fee | 1.05% of the settled amount or AED 10,500, whichever is lower |

| Late Payment Fee | 2% of the delayed amount (minimum AED 52.50, maximum AED 210) |

| Minimum Salary | ● AED 5,000 for approved companies, ● AED 10,000 for unapproved companies |

| Employment | Confirmed employee or minimum 6 months with the current employer |

| Documentation Required | Valid Emirates ID |

| Insurance | Life insurance for Emiratis with free coverage |

| Additional Fees | ● Postponement Fee: AED 105 per postponement ● Loan Rescheduling Fee: AED 262.50 ● Loan Cancellation Fee: AED 105 |

| Benefits | ● Instant online approval in 5 minutes ● Competitive interest rates ● 1st EMI deferral period of up to 90 days |

| Loan Features | ● Reducing rate of interest ● Free life insurance coverage for Emiratis with death benefit (conditions apply) |

| Terms & Conditions | ● Detailed terms and conditions apply, ● Including application process, ● disbursement, ● repayments, ● fees, and defaults. |

| Full Disclosure | Comprehensive legal terms and conditions provided by Mashreq Bank |

| Loan Application Process | Online |

Benefits

Mashreq Bank personal loan comes with many benefits. If you take a personal loan from this bank, then you can avail these benefits:

- High Loan Amount: Borrow up to 20 times your salary or a maximum of AED 1 million.

- Fast Approval: Get approved for your loan in just 5 minutes through the online application process.

- Competitive Rates: Enjoy competitive interest rates on your loan.

- Flexible Repayment: Defer your first Equated Monthly Installment (EMI) for up to 90 days (terms apply).

- Minimal Salary Requirement: Qualify for a loan with a minimum monthly salary of AED 5,000 (approved companies) or AED 10,000 (unapproved companies).

- No Company Approval Needed: Employment with a pre-approved company is not mandatory.

- Free Life Insurance (Optional): Get free life insurance coverage for a death benefit (subject to eligibility).

- Manage Existing Debt: Consolidate your existing debts into one manageable loan.

- Cover Unexpected Expenses: Address unforeseen financial needs with ease.

- Plan for Your Goals: Finance your dream vacation, home improvement project, or other important goals.

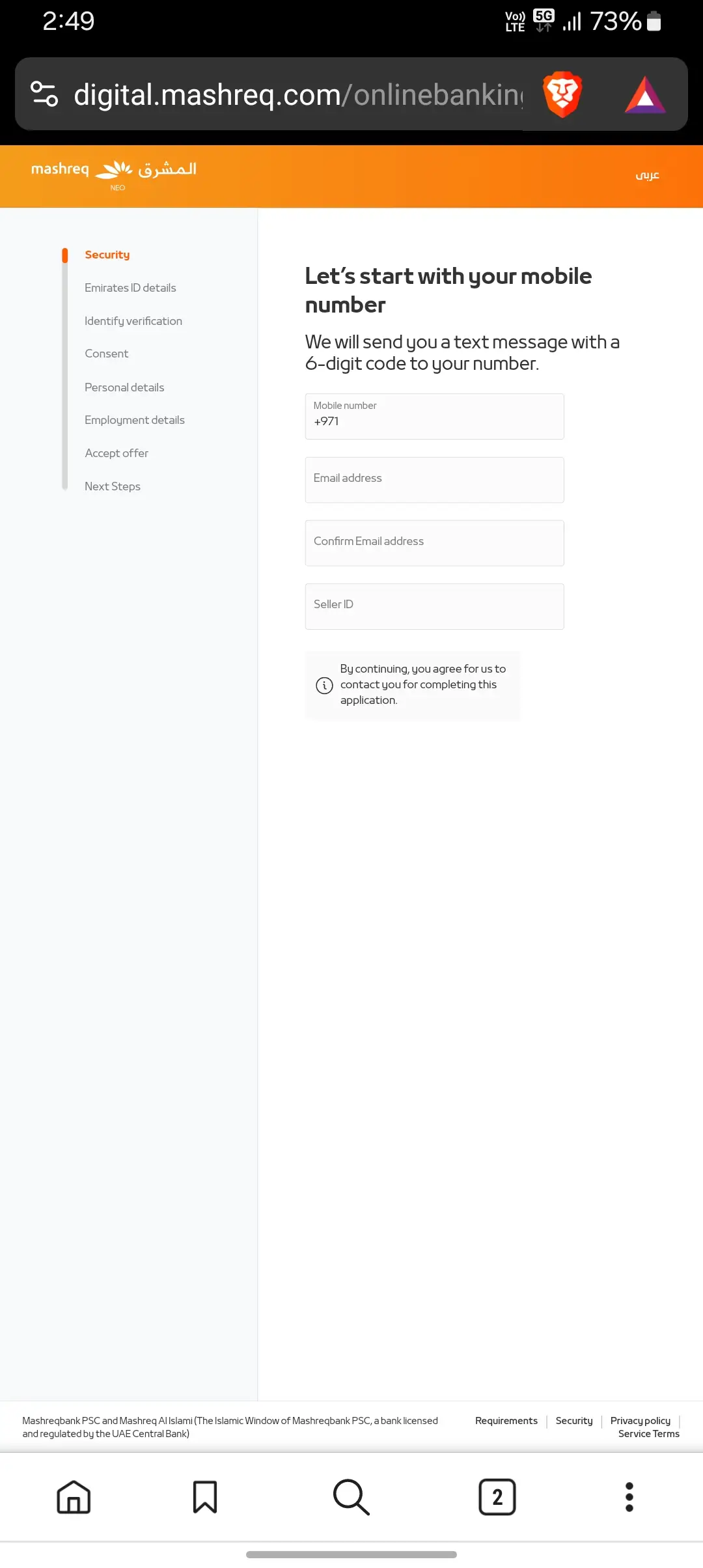

How To Apply Mashreq Bank Personal Loan for Existing Customers

After being an existing customer of Mashreq Bank, you can apply for instant personal loan from its website. You can also take this loan from your nearest branch. Apart from this, you can also take this loan through its mobile application here. But you have been told step by step process for Mashreq Bank Personal Loan for Existing Customers, by following which you will be able to take this loan:

1. Open Mashreq Bank Website:

- Go to the Mashreq Bank website: Mashreq Bank Official Website.

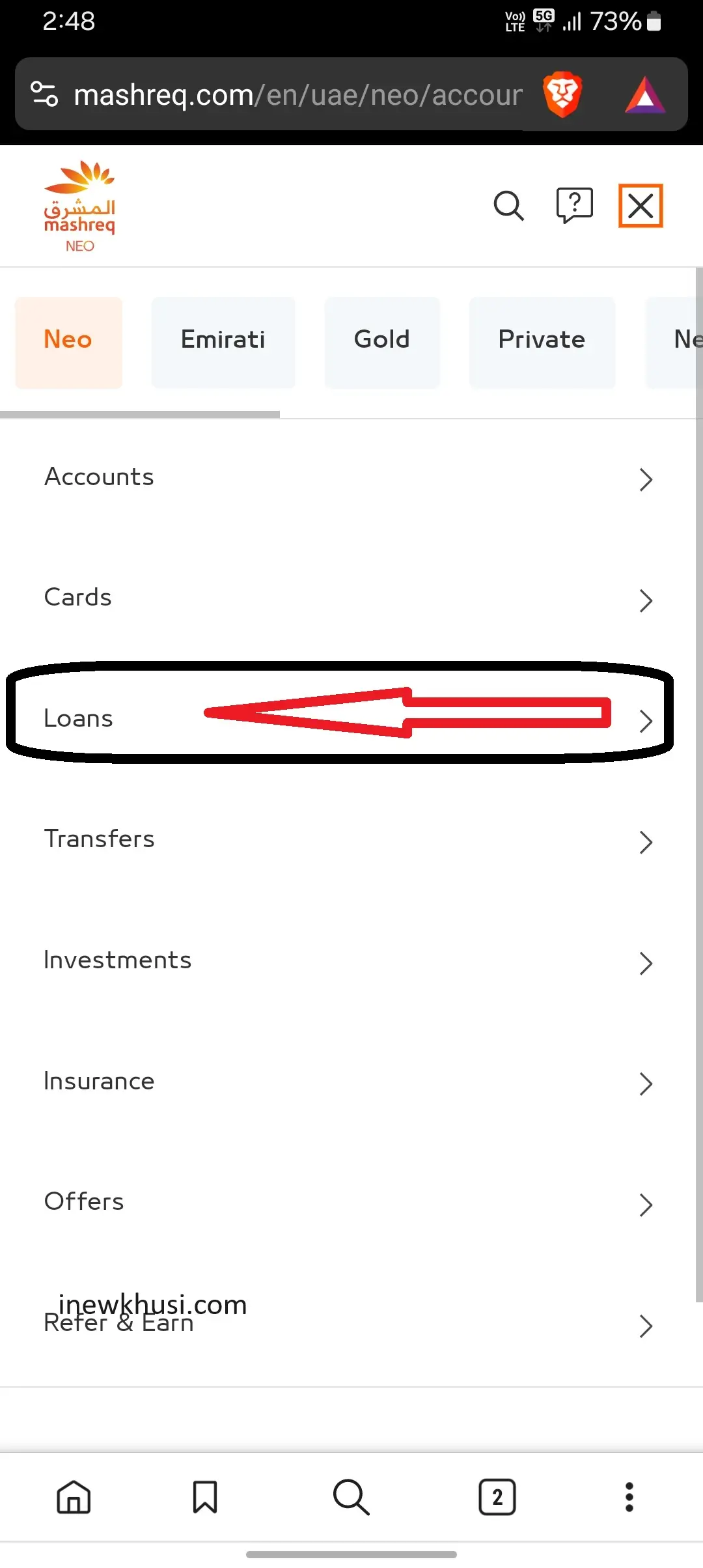

2. Navigate to Loans Section:

Click on the menu section and select “Loans”.

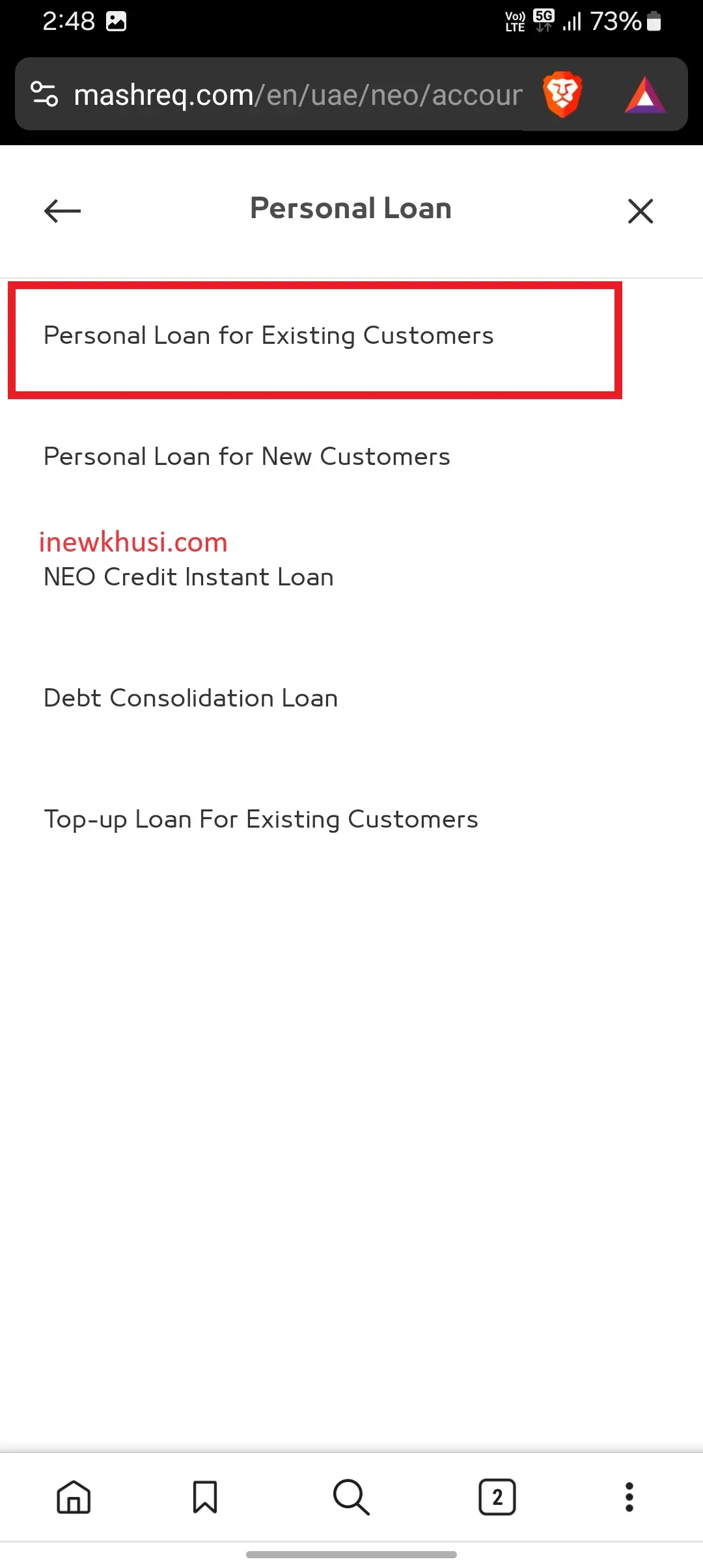

3. Select Personal Loan for Existing Customers:

Choose “Mashreq Bank Personal Loan for Existing Customers” from the options.

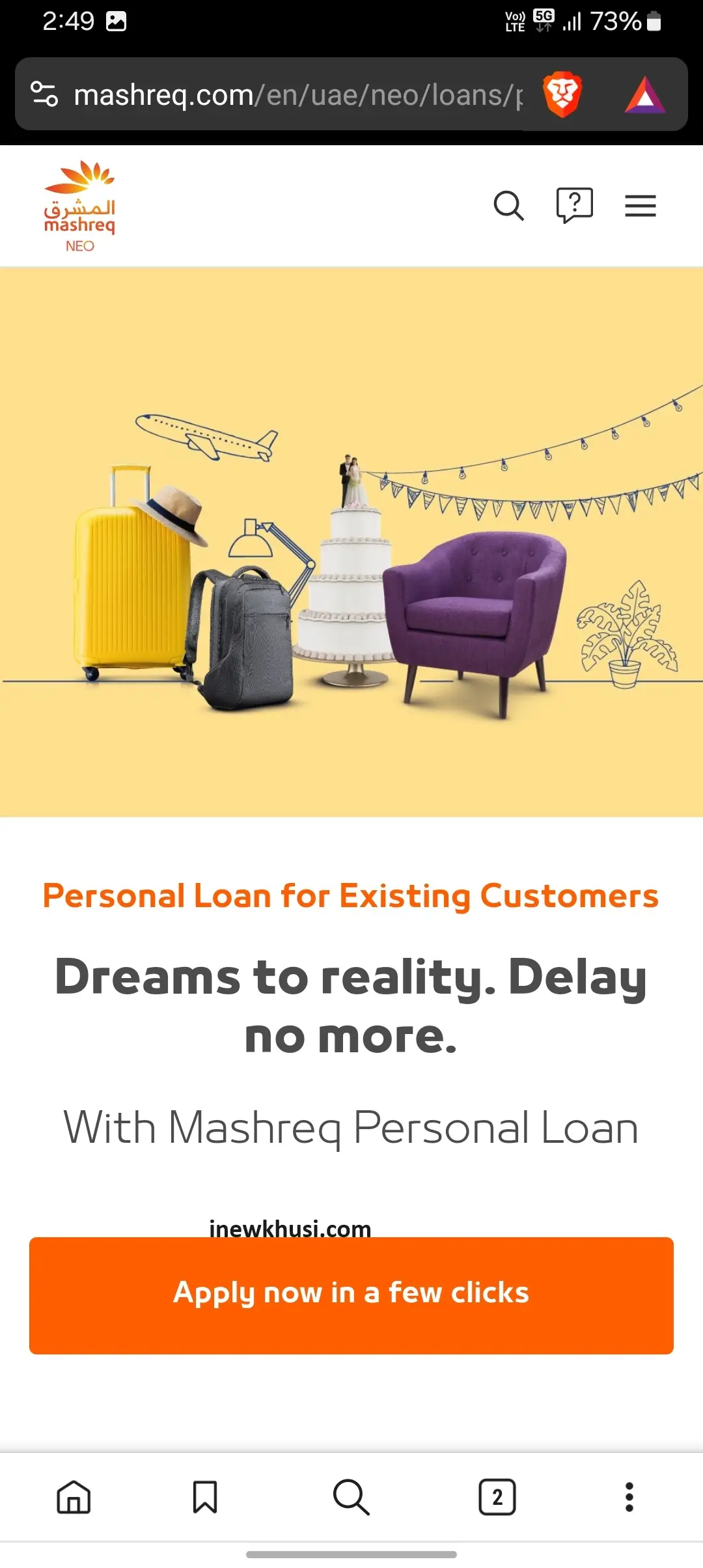

4. Redirect to Application Page:

You will be redirected to the application page. Click on “Apply now in a few clicks”.

5. Enter Your Details:

Enter your mobile number starting with +971.

Provide your email address and confirm it.

Enter the Seller ID if applicable.

Agree to be contacted for completing the application.

6. Enter Emirates ID Details:

Input your Emirates ID details for verification.

7. Identity Verification:

Complete the identity verification process as prompted.

8. Consent:

Provide consent for the loan application process.

9. Personal Details:

Fill in your personal details as required.

10. Employment Details:

Enter your employment details, including your current job status and employer information.

11. Accept Offer:

Review the loan offer details provided.

12.Next Steps:

Follow any additional steps or instructions provided to complete your application.

13. Transfer Money to Your Bank Account:

Once approved, the loan amount will be transferred to your designated bank account.

This process ensures you can smoothly apply for a Mashreq Bank Personal Loan for Existing Customers online.

Mashreq Bank Loan usage

Mashreq Bank Personal Loan for Existing Customers does not restrict how you use the loan. The bank offers the loan for various purposes, including:

- Consolidation of Debt: Combine multiple debts (credit cards, other loans) into one manageable loan.

- Unexpected Expenses: Cover unforeseen financial needs like car repairs or medical bills.

- Planned Expenses: Finance a dream vacation, home renovation, wedding, or educational needs.

- Large Purchases: Fund a major purchase you’ve been saving for, like furniture or appliances.

- Home Improvements: Renovate or remodel your home to enhance its value or improve living conditions.

- Education: Fund tuition fees, books, and other educational expenses for yourself or your dependents.

- Wedding Expenses: Cover costs related to weddings, including venue, catering, and other services.

- Travel: Finance your dream vacation or travel plans without disrupting your savings.

- Medical Expenses: Cover medical bills, treatments, or unexpected healthcare costs.

- Vehicle Purchase: Use funds toward purchasing a new or used car, motorcycle, or other vehicles.

- Business Ventures: Start or expand a small business, including purchasing inventory or equipment.

- Emergency Situations: Handle unforeseen expenses like repairs or urgent bills.

Eligibility Criteria

The eligibility criteria for Mashreq Bank’s Personal Loan for Existing Customers is as follows:

- Minimum Monthly Salary: You should get at least AED 5,000 per month by working in approved companies. If you work in unapproved companies, your salary should be at least AED 10,000.

- Loan Installment: The installment should not be more than 50% of your monthly salary. Meaning, the total regular installments (including loan) should not be more than 50% of your monthly salary.

- Employment: You must have confirmed employment with your current employer for at least 6 months.

- Documents Required: To apply for the loan, you will have to submit a valid Emirates ID and necessary documents required by the bank.

If you fulfill these criteria, then you can be eligible for Mashreq Bank Personal Loan for Existing Customers. For more information, contact the bank directly or visit their official website.

Required documents

The list of documents required for Mashreq Bank Personal Loan for Existing Customers is as follows:

| Document Category | Possible Documents |

|---|---|

| Identification | Emirates ID (Original and valid) |

| Employment | Salary Certificate (Latest, specific format for non-approved companies) or Salary Transfer Letter |

| Contact Information | Utility Bill (Optional, for address verification) |

| Financial | Bank Statements (Last 3-6 months) |

| Loan Application | Completed Application Form |

| Additional for Expatriates | Passport (Valid) and Visa (For expatriates only) |

Mashreq Bank Personal Loan Interest Rates (Existing Customers)

If you are an existing customer of Mashreq Bank, then you will have to pay interest with reducing interest. If you live among Expatriates then the interest starts from 5.99% to 31.99% whereas if you live among Emiratis then the interest starts from 5.99% to 12.99%.

| Loan Category | Reducing Rate of Interest (VAT not applicable) |

|---|---|

| Expatriates | 5.99% to 31.99% |

| Emiratis | 5.99% to 12.99% |

Personal Loan Emi Calculator

Example

If you are a customer of Mashreq Bank, then I would like to explain this information to you with a small example. The example given here will help you learn how this loan actually works out, assuming you get a loan of AED 12,000 for a 12 month term and the interest rate is 4.5%.

| Loan Amount | Interest Rate | Payback Period | Monthly Installment |

|---|---|---|---|

| AED 12,000 | 4.5% | 12 months | AED 1,025 |

| Payment Year | Monthly Installment (AED) | Principal (AED) | Interest (AED) | Balance (AED) |

|---|---|---|---|---|

| 2024 | 1,025 | 5,936 | 214 | 6,064 |

| 2025 | 1,025 | 6,070 | 80 | 0 |

Loan Offer PDF: Mashreq Bank Loan Offer For Existing Customer PDF

Loan Amount

You can get a personal loan from Mashreq Bank up to 20 times your salary, the maximum loan can be taken here up to one million dirhams. Information about how much loan you will be able to take from here is given in the table below, which is as follows:

| Parameter | Loan Amount |

|---|---|

| Maximum Loan Amount | AED 1 million |

| Salary Multiple | Up to 20 times your monthly salary |

Loan Tenure

If you are an existing customer of Mashreq Bank, then you can avail the loan from here for 6 months to 48 months. You will get this loan directly in your bank account for which you will have to complete the online process. The main information about this loan is as follows:

| Parameter | Loan Tenure |

|---|---|

| Minimum Tenure | 6 months |

| Maximum Tenure | 48 months (4 years) |

Fees And Charges

If you are an existing customer of Mashreq Bank, then you should know what fees and charges will be levied on taking a personal loan.

| Fee Type | Amount/Description |

|---|---|

| Processing Fee | 1.05% of the loan amount |

| Early Settlement Fee | 1.05% of the settled amount or AED 10,500, whichever is lower |

| Late Payment Fee | ● 2% of the delayed amount (minimum AED 52.50, ● Maximum AED 210) |

| Postponement Fee | AED 105 per postponement |

| Loan Rescheduling Fee | AED 262.50 |

| Loan Cancellation Fee | AED 105 |

| Life Insurance | Free life insurance coverage for Emiratis (certain conditions apply) |

| Loan Top-up Fee | 1.05% of the top-up amount |

| Other Fees | Fees for various services like loan rescheduling, clearances, and additional administrative fees |

Pros and cons

There are many benefits of taking Mashreq Bank Personal Loan, here we have explained some pros and cons of this loan in the table below.

| Pros | Cons |

|---|---|

| Competitive Interest Rates: Mashreq Bank offers competitive interest rates on personal loans, making it affordable for borrowers. | High Minimum Salary Requirement: AED 5,000 for approved companies and AED 10,000 for unapproved companies may limit access to lower-income individuals. |

| Online Approval: Quick and convenient online approval process allows for speedy disbursal of funds. | Processing Fees: A processing fee of 1.05% of the loan amount can add to the overall cost of borrowing. |

| Flexible Repayment Options: Borrowers have the flexibility to choose from various repayment methods, making it easier to manage their finances. | Early Settlement Fee: There is an early settlement fee of 1.05% of the settled amount or AED 10,500, whichever is lower, which may deter borrowers from clearing their debt early. |

| Free Life Insurance: Emirati borrowers benefit from free life insurance coverage, providing added financial security. | Late Payment Charges: Late payment fees of 2% of the overdue amount (with minimum AED 52.50 and maximum AED 210) apply, which could increase the overall cost of the loan if payments are missed. |

| Loan Top-Up Option: Existing customers can opt for a loan top-up, providing additional funds without applying for a new loan. | Eligibility Criteria: Strict employment and salary requirements may exclude some potential borrowers from accessing the loan. |

What things should you keep in mind while taking a personal loan from Mashreq Bank

1. Check Interest Rates and Charges

2. Select a reliable maturity date

3. Understand additional charges (such as early payment fees)

4. Guarantee timely payment

5. Check the financial facilities available

6. Consider the expectations and reality of a lane-walker

7. Understanding of regular payment deadlines and reporting policies

8. Use regulated financial advice

9. Pay attention to cash withdrawals and unexpected charges

10. Create a reliable financial budget and stick to it.

Can I get a personal loan from Mashreq Bank?

You may be eligible for a personal loan from Mashreq Bank if you meet the following criteria:

1. To work in recognized companies, one must have a monthly salary of at least AED 5,000. If you are working in non accredited companies, the monthly salary should be at least AED 10,000.

2. You must have at least 6 months of confirmed employment in the current company.

3. All required documents required, such as recognized Emirati ID, salary certificate, and last 3 months bank statements.

Additionally, loan eligibility and interest rates may also depend on your financial situation. You are best advised to contact Mashreq Bank directly or visit their official website and get more information.

What needs to be done to take a personal loan from Mashreq Bank?

To take a personal loan from Mashreq Bank, you must be an existing customer of this bank. You can take this loan by filling the loan application form through its website, mobile application or by visiting your nearest branch. As soon as your loan is approved, you will have to submit your details. The loan amount will be transferred to the bank account by this bank.

Customer care number

If you are facing any kind of problem while taking a personal loan from Mashreq Bank, then you can call the customer care numbers of this bank:

| Service | Contact Number |

|---|---|

| Technical Support | +971 4 424 4611 (24×7) |

| Customer Care Number | +971 4 424 4411 |

FAQ: Personal Loan from Mashreq Bank

How do I get a personal loan from Mashreq Bank?

You have to apply online by visiting the official website of Mashreq Bank. Or you can avail the benefit of this personal loan by applying for the loan through its mobile application.

What are the eligibility criteria for Mashreq Bank Personal Loan?

To avail Mashreq Bank Personal Loan, your minimum monthly income should be 5,000 AD (for approved companies) and 10,000 AD (for unapproved companies). Also, you must have at least 6 months of experience in your current company.

What are the documents required for Mashreq Bank Loan?

To avail Mashreq Bank Loan you will need documents like valid ID, last 3 months bank statements, latest salary certificate and salary transfer letter for unavailable companies.

How to apply for Mashreq Bank Loan?

Visit Mashreq Bank website and fill the loan application procedural form and upload the required documents. If you are eligible for loan then you will get the loan from here.

How long does it take for funds to be transferred after Mashreq Bank loan approval?

The loan given by Mashreq Bank may take 24 to 48 hours to be transferred to the bank account. The funds are usually transferred to your bank account.

What kind of repairs do I need to do on Mashreq Bank Loan?

Mashreq Bank Loan repayments are made from your bank account regularly and on time.

Conclusion

Personal loan from Mashreq Bank can be a convenient option that can help you meet your various financial needs. This loan can help you meet business or personal expenses as per your monthly income, while also providing you the facility of easy and secure payments. However, while taking a loan it is very important to read and understand the interest rate, charges and terms carefully so that you understand all the controversial issues before availing the loan. If you need any kind of more information or help, you can comment below, you will get a reply within 2 hours.