Many banks are now fulfilling the dream of buying their own house in the UAE. Mashreq Bank’s Home Loan for Residence can prove to be a good option for you. Whether you are a UAE resident, expat, or citizen, you can find out what loan amount you can avail, with pre-approval in just 10 minutes.

With a loan amount up to 85% of the property value and no need for salary transfer, it simplifies the home loan process.

With a high loan amount up to a maximum of AED 10 million and a long repayment tenure of up to 25 years, this loan not only offers generous limits but also comes with low interest rates.

In this article, we will discuss in detail the home loan options available to UAE residents, their eligibility, and benefits, so that you can make the right financial decision to purchase your dream home.

| Summary:- 1. Loan Amount and Tenure: Mashreq Bank Home Loan offers you a loan amount of up to AED 10 million with a repayment tenure of up to 25 years, resulting in low monthly installments. 2. Loan Process: Pre-approval is available in just 10 minutes. The application and documentation process is simple and quick, and no salary transfer is required. 3. Interest rates and insurance: The bank offers low interest rates and life and property insurance is mandatory, which provides protection. 4. Eligibility Criteria: Applicants must have a monthly salary of AED 15,000, and must be a UAE citizen or resident expatriate. Employed or self-employed individuals may also be eligible. 5. Service and Support: Mashreq Bank’s services and customer feedback reviews have been positive. Detailed information is available on our website inewkhusi.com and you can get information in Hindi, English, Arabic, and Urdu. |

What is a home loan

Due to the rapidly increasing residential demand and stable lifestyle in the UAE, buying your own home has become an important necessity for people. Home loan is a financial facility that provides individuals with the necessary funds to purchase their dream home.

This loan is usually given up to a fixed percentage of the property value and can be repaid in easy monthly installments (EMIs) over a long period.

For UAE people, the biggest advantage of taking a home loan is that both availing and repaying it is quite simple and accessible, with the process being fast and without the need for salary transfer.

Mashreq Bank Home Loan Overview for Residents

Taking a home loan can be an important decision for UAE residents as it helps them buy their dream home.

With the booming real estate market and the desire for a stable lifestyle, buying a home has become an essential step.

There are some basic requirements to avail a home loan, such as the minimum monthly income must be AED 15,000 and the applicant must be a UAE citizen or resident expatriate.

The application process to check loan eligibility is simple and quick, with pre-approval available in just 10 minutes.

Information about this loan provided by Mashreq Bank is given in the table below which is as follows:

| Feature | Information |

|---|---|

| Loan Name | Home Loan for Residents |

| Loan Amount | Maximum AED 10 million |

| Loan Period | Maximum 25 years |

| Percentage of Property Value | Up to 85% of the value of the property |

| Pre-Approval | Free Pre-Approval in Just 10 Minutes |

| Employment Status | Employed or self-employed person |

| Minimum Monthly Salary | AED 15,000 |

| Visa Eligibility | UAE citizen or resident expatriate |

| Interest Rate | Low interest rate options available |

| Insurance Required | Compulsory life and property insurance through Oman Insurance Company (OIC) |

| Required Documents | – Application Form – Copy of Passport, Visa, and Emirates ID – Certificate of Income |

| Additional Requirements | – Property and Life Insurance – Letters of liability, purchase contracts, receipts for advance payments |

| Application Evaluation | Based on income, employment stability, existing debt, property value, and assets |

| Refinance Option | Available to all residents, expatriates, and UAE citizens |

| Resale Transaction | Supported (Full Payment and Partial Payment Options) |

| Co-Borrower | All co-owners of the property should be co-borrowers |

| Loan Approval Time | Pre-approval in 10 minutes; The entire process is completed in a few days |

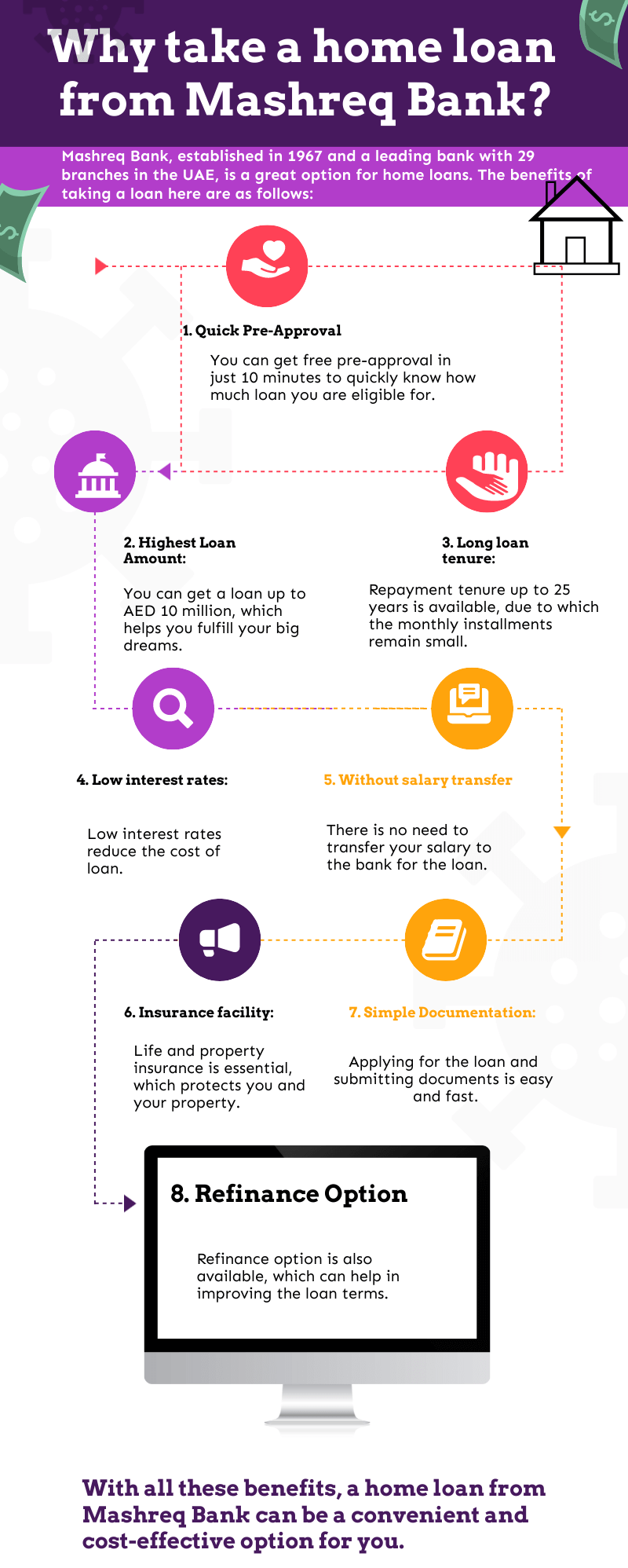

Why take a home loan from Mashreq Bank?

Mashreq Bank, established in 1967 and a leading bank with 29 branches in the UAE, is a great option for home loans. The benefits of taking a loan here are as follows:

1. Quick Pre-Approval: You can get free pre-approval in just 10 minutes to quickly know how much loan you are eligible for.

2. Highest Loan Amount: You can get a loan up to AED 10 million, which helps you fulfill your big dreams.

3. Long loan tenure: Repayment tenure up to 25 years is available, due to which the monthly installments remain small.

4. Low interest rates: Low interest rates reduce the cost of loan.

5. Without salary transfer: There is no need to transfer your salary to the bank for the loan.

6. Insurance facility: Life and property insurance is essential, which protects you and your property.

7. Simple Documentation: Applying for the loan and submitting documents is easy and fast.

8. Refinance Option: Refinance option is also available, which can help in improving the loan terms.

With all these benefits, a home loan from Mashreq Bank can be a convenient and cost-effective option for you.

Eligibility Criteria for Home Loan from Mashreq Bank

The following are the eligibility criteria to avail a home loan from Mashreq Bank:

- Minimum Monthly Salary: Applicant’s monthly salary must be at least AED 15,000.

- Employment Status: You can be a salaried or self-employed person.

- Visa: You must be a UAE citizen or resident expatriate.

- Income and Documents: Relevant documents such as salary certificates, bank statements, and visa copies will be required to verify your income.

- Value of the property: While applying for the loan, the value of the property and your current financial position will also be assessed to decide the loan amount.

Upon meeting these criteria, you can be eligible for a home loan from Mashreq Bank.

Documents required for home loan from Mashreq Bank

The list of documents required to get a home loan from Mashreq Bank is as follows:

1. Application Form: Completed application form provided by the Bank.

2. Identity proof: Copy of passport, visa, and copy of Emirates ID.

3. Proof of Income:

- For employed persons:

- Salary Certificate (in the name of Mashreq Bank)

- Bank statements of last 6 months

- liability letter from bank

- For self-employed persons:

- Personal and Company Bank Statements of last 6 months

- Two years’ audited financial statements

- copy of business license

- Copy of company accounts and board resolution

4. Property Documents:

- Copy of property purchase contract

- advance payment receipts

- insurance document

- Confirmation of Life and Property Insurance (through Oman Insurance Company)

With the help of these documents, Mashreq Bank will process your home loan application and help in loan approval.

Mashreq Bank Home Loan Interest rate, Tenure, Loan Amount

It is very easy to get a home loan from Mashreq Bank. If you take a home loan, then how much interest will be charged, how much loan amount can be got, and in how much time you can deposit this loan. I have explained all this below which is as follows:

1. Loan Amount:

You can get a maximum home loan up to AED 10 million from Mashreq Bank. This amount can be helpful in realizing your dreams, whether it is buying a new home or improving an existing property.

2. Tenure:

The repayment tenure of a home loan can be up to 25 years. Due to this longer tenure, your monthly installments remain smaller, making it easier to repay the loan.

3. Interest Rate:

Home loan interest rates at Mashreq Bank are low and attractive. You get the benefit of competitive interest rates, which helps in reducing the overall cost of the loan. Interest rates are determined based on the amount and tenure of your loan.

Home Loan Emi Calculator For Dubai UAE

How to apply for home loan from Mashreq Bank

To take a home loan from Mashreq Bank, you can apply for this loan at your nearest branch or you can apply for this loan through its official website. The complete step by step process of applying for a home loan is explained here which is as follows:

1. Fill the application form: First of all, visit Mashreq Bank website or nearest branch to get the home loan application form and fill it correctly.

2. Prepare Documents: Gather the necessary documents such as passport, visa, Emirates ID, proof of income, property documents, and insurance documents.

3. Apply Online or in Branch: You can apply online on Mashreq Bank website or submit the application in person by visiting the nearest branch.

4. Submit Documents: Submit all the required documents along with the application form. If you are applying online, upload the documents in digital form.

5. Processing and Pre-Approval: The Bank will review your application and documents. Typically you will get pre-approval within 10 minutes.

6. Loan Approval: After pre-approval, the bank will complete your complete application process and contact you for final approval of the loan.

7. Loan Disbursal: Once the loan is approved, the amount will be transferred to your account as per the prescribed procedure.

By following these simple steps, you can easily get a home loan from Mashreq Bank.

Why choose Home Loan from Mashreq Bank?

The reason to choose a home loan from Mashreq Bank is that this bank offers loans with great features and flexibility for you. Its quick pre-approval process helps you know the loan status as soon as possible, and the highest loan amount up to AED 10 million and long repayment tenure of 25 years eases your financial burden.

Low interest rates, no salary transfer required, and simple documentation process make this loan even more attractive. Furthermore, additional features like life and property insurance ensure your protection.

For all these reasons, a home loan from Mashreq Bank is an excellent option for your financial and housing needs.

What things should be kept in mind while taking home loan from Mashreq Bank

It is important to keep some important things in mind while taking a home loan from Mashreq Bank.

- First, decide the loan amount and tenure as per your budget and needs so that your monthly installments fit your financial situation.

- Check your credit score beforehand and compare interest rates from different banks so that you can get the best offer.

- Keep all the necessary documents like income certificate, identity card, and property documents ready and read the loan terms carefully.

- Conversely, don’t make hasty decisions and avoid getting interest rates from only one bank.

- Do not ignore your credit score and lack the required documents, otherwise the loan processing may get delayed or the application may get rejected.

- Also avoid ignoring the loan terms, as this can lead to problems in the future.

Is it safe to take a home loan from Mashreq Bank?

Taking a home loan from Mashreq Bank can be done with security and confidence. The bank has a strong and prestigious history dating back to 1967, and is the oldest private bank in the UAE.

The Bank’s services include state-of-the-art security technology and strong financial management policies, ensuring the security of your financial data and transactions.

Additionally, your loan is also secured with life and property insurance mandated by Mashreq Bank, ensuring the safety of you and your assets. Positive customer reviews and the stability of the bank confirm that taking a home loan from Mashreq Bank is a safe and reliable option.

How would it be to take a home loan from Mashreq Bank?

Taking a home loan from Mashreq Bank can be an excellent option, as many customers have experienced. The bank’s quick pre-approval process and low interest rates are quite attractive for customers.

Additionally, the long repayment tenure and maximum loan amount up to AED 10 million helps in lightening your financial burden.

According to customer reviews, the bank’s customer service is also very effective, making the application process smooth and stress-free.

Features like simple documentation and no salary transfer requirement make this loan even more convenient.

Overall, taking a home loan from Mashreq Bank can prove to be a reliable and beneficial option to meet your housing needs.

Home loan review from Mashreq Bank

Taking a home loan from Mashreq Bank is an ideal option keeping in mind the diverse needs of the customers. This bank’s quick pre-approval process and the highest loan amount up to AED 10 million can easily fulfill your big dreams.

Long term repayment period (25 years) and low interest rates make the loan friendly according to your financial condition.

In addition, the need for without salary transfer and simple documentation process makes it even easier to get a loan.

Customers also get insurance facilities, protecting their investment. Thus, the facilities and loan conditions of the Mashreq bank make your financial security and loan process simple and beneficial.

FAQS: Home Loan from Mashreq Bank

1. What is the eligibility to take a home loan from Mashreq Bank?

The eligibility for taking a home loan from Mashreq Bank must be minimum monthly salary AED 15,000. The applicant should be a employee or self-employed person. The applicant should be a UAE citizen or resident migrant.

2. How much loan amount can be found and what is the loan duration?

The maximum loan amount can be up to 10 million AED. The loan duration can be up to 25 years.

3. How long does it take to apply for a loan?

The pre-ephemeral process is completed in only 10 minutes, and the process of complete approval is also quick.

4. Does salary transfer require?

No, the loan does not require salary transfer.

5. Does insurance require?

Yes, life and property insurance with loans is mandatory, which is obtained through Oman Insurance Company (OIC).

6. Can I refine my home loan?

Yes, Mashreq Bank offers refinance options, which allows you to refinance the loan with better conditions.

7. What is the process of application for home loan?

Fill the application form to apply Mashreq Bank Home Loan, submit all the required documents, and read the bank’s terms carefully. Subsequently, the bank will process your loan application and provide pre-approvement.

Conclusion

The home loan of Mashreq Bank can be used to make new home shopping, refinance existing property, or new property. According to customer feedback, the process of Mashreq Bank is fast and reliable. Our website, Inwkhusi.com, you get information related to bank accounts, personal loans, savings accounts, credit cards, EMI cards, and other finance. We provide information in Hindi, English, Arabic, and Urdu and solve your problems within 2 hours. Please share this information with your friends, like, and stay for our updates.