The banking sector in the United Arab Emirates (UAE) is large and competitive, with 22 local and 30 foreign banks. Due to this competition, banks have attractive offers on savings accounts, which can make choosing the right account challenging.

Choosing the right savings account is important as it keeps your savings safe and gives you good interest rates and facilities.

In this guide, we have given information about the top 10 savings accounts in UAE, such as iSave Account of First Abu Dhabi Bank (FAB), Long-term and Monthly Payment Wakala Deposits of Dubai Islamic Bank (DIB), Abu Dhabi Islamic Bank ( ADIB’s Savings Account, RAKBANK’s Savings and Fixed Deposit Plus Accounts, Commercial Bank of Dubai (CBD)’s Bonus Booster Deposit, Emirates NBD’s Currency Passport Savings Account, Mashreq Bank’s MaxSaver Account, and Abu Dhabi Commercial Bank’s (ADCB) Active Saver Account.

All of these accounts come with different features and interest rates, and in this guide we’ve explained their benefits and drawbacks so you can choose the account that best suits your needs.

| Summary:- 1. Top Savings Accounts Overview : The UAE’s competitive banking sector offers various savings accounts with differing features and interest rates. Notable accounts include FAB’s iSave Account, DIB’s Wakala Deposits, and ADIB’s Savings Account, among others. 2. Account Features: Each account has unique benefits such as high interest rates, no minimum balance requirements, or flexible withdrawal options. For instance, FAB’s iSave Account offers high returns with no minimum balance, while DIB’s Long-term Wakala Deposit provides high interest rates for larger minimum balances. 3. Choosing the Right Account: Factors to consider include interest rates, minimum balance requirements, flexibility in withdrawals, and availability of foreign currency options. Understanding these can help tailor the best account to your financial goals. 4. Maximizing Benefits : To make the most of your savings account, choose one with high interest rates, make regular deposits, use digital banking tools, and avoid unnecessary fees. These steps can enhance your savings growth and account management. 5. Final Tips and Resources : Before making a decision, review the latest information on banks’ official websites. For detailed and accurate information, visit Inewkhusi.com, where articles are available in multiple languages and customer queries are addressed promptly. |

List of banks and their available savings accounts

Various banks in UAE offer a variety of savings accounts to their customers, making their savings safe and profitable. This list contains details of the top savings accounts offered by major banks. These accounts have different interest rates, minimum balance requirements, and withdrawal terms, offering different benefits depending on your financial goals and needs.

| Bank Name | Account Name |

|---|---|

| First Abu Dhabi Bank (FAB) | iSave Account |

| Dubai Islamic Bank (DIB) | Long-term Wakala Deposit, Monthly Payment Wakala Deposit |

| Abu Dhabi Islamic Bank (ADIB) | Savings Account |

| RAKBANK | Savings Account, Fixed Deposit Plus |

| Commercial Bank of Dubai (CBD) | Bonus Booster Deposit |

| Emirates NBD | Currency Passport Savings Account |

| Mashreq Bank | MaxSaver Account |

| Abu Dhabi Commercial Bank (ADCB) | Active Saver Account |

Top 10 Savings Accounts in UAE Overview

When you’re looking for the best savings accounts in the UAE, there are several important criteria to consider. Prominent among these criteria are:

List of the Top 10 Savings Accounts 2024-25

The list of top 10 savings accounts available in UAE gives you a glimpse of the best features and interest rates offered by different banks.

By looking at this list, you can choose the most suitable account as per your needs which can suit your savings and investment strategy.

| Sr No | Bank | Account Name | Interest Rate | Minimum Balance | Withdrawal Terms | Currency Options |

|---|---|---|---|---|---|---|

| 1 | First Abu Dhabi Bank (FAB) | iSave Account | Highest Rates Available | No minimum balance | No limit | AED |

| 2 | Dubai Islamic Bank (DIB) | Long-term Wakala Deposit | 2.65% p.a. | AED 25,000 | Some benefits with premature liquidation | AED |

| 3 | Dubai Islamic Bank (DIB) | Monthly Payment Wakala Deposit | From 1.6% to 2.6% | AED 25,000 | Flexible Tenure | AED |

| 4 | Abu Dhabi Islamic Bank (ADIB) | Savings Account | 0.35% to 0.37% | 5,000 units | No withdrawal limit | AED, USD, EUR, GBP, CHF, CAD, JPY |

| 5 | RAKBANK | Savings Account | 0.25% | 3,000 units | 1% additional interest for USD accounts | AED, USD |

| 6 | Commercial Bank of Dubai (CBD) | Bonus Booster Deposit | 2.02% per annum | AED 1,000 per month | Fixed tenure | AED |

| 7 | Emirates NBD | Currency Passport Savings Account | 0.15% Variable | No minimum balance | No withdrawal limit | Several major foreign currencies |

| 8 | RAKBANK | Fixed Deposit Plus | From 1.25% to 2.1% | USD 25,000 | Higher interest rates for longer periods | USD |

| 9 | Mashreq Bank | MaxSaver Account | 1.2% | No minimum balance | One transaction per month without penalty | AED |

| 10 | Abu Dhabi Commercial Bank (ADCB) | Active Saver Account | From 0.55% to 1.15% | USD 1,000,000 or AED 10,000,000 | No withdrawal limit | AED, USD, GBP |

Detailed Reviews of Top Savings Accounts

Where we will review the top saving accounts of UAE, here we will tell you in which bank you can open a savings account, what benefits you will get after opening the account, what can be the disadvantages, the criteria for opening the account.

Will be explained in detail. This information will help you choose the right account.

1. iSave Account by First Abu Dhabi Bank (FAB)

FAB’s iSave Account is a flexible and convenient option with high interest rates. There is no minimum balance requirement and no limit on withdrawals, which makes it very useful. This account is ideal for those who want good returns while keeping their savings safe.

Pros

- high interest rates

- No minimum balance required

- No limit on withdrawals

Cons

- Interest rates may depend on promotional offers

- Features can be complex

Eligibility Criteria:

– Must be a resident of UAE

– Must be 21 years of age or older

2. Long-term Wakala Deposit by Dubai Islamic Bank (DIB)

Dubai Islamic Bank’s Long-term Wakala Deposit offers high interest rates for a long period, up to 2.65%. It requires a minimum balance of AED 25,000 to open and also has the facility of premature liquidation, allowing you to withdraw the amount as and when required.

Pros

- high interest rates

- Premature liquidation facility

Cons

- Minimum balance required

- Limited flexibility on withdrawals

Eligibility Criteria:

Must be a resident of UAE

Maintain minimum balance

3. Monthly Payment Wakala Deposit by Dubai Islamic Bank (DIB)

Monthly Payment Wakala Deposit provides the facility of monthly interest payment and the interest rate ranges from 1.6% to 2.6%. It requires a minimum balance of AED 25,000 and also has flexible tenure options available, making it suitable for those with a busy lifestyle.

Pros

- Monthly interest payment

- Flexible tenure

Cons

- Minimum balance required

- Interest rates may depend on economic conditions

Eligibility Criteria

Must be a resident of UAE

Maintain minimum balance

4. Savings Account by Abu Dhabi Islamic Bank (ADIB)

Abu Dhabi Islamic Bank’s Savings Account is available in different currencies and has interest rates ranging from 0.35% to 0.37%. For this a minimum balance of 5,000 units is required. This account is suitable for those who want to save in different currencies.

Pros

- Facility to open accounts in different currencies

- Relatively low minimum balance amount

Cons

- Interest rates are relatively low

- There may be additional charges for additional features

Eligibility Criteria:

Must be a resident of UAE

Minimum balance must be met

5. Savings Account by RAKBANK

RAKBANK’s Savings Account offers an interest rate of 0.25% with additional interest on USD accounts. It has a minimum balance requirement of 3,000 units and also offers an additional 1% interest for USD accounts, making it ideal for people looking to save in foreign currency.

Pros

- Higher interest rates on USD accounts

- Relatively low minimum balance amount

Cons

- Interest rates may decrease

- Special offers may be for a limited period of time

Eligibility Criteria:

Must be a resident of UAE

Minimum balance must be met

6. Bonus Booster Deposit by Commercial Bank of Dubai (CBD)

Commercial Bank of Dubai’s Bonus Booster Deposit offers an interest rate of 2.02% per annum and requires a minimum balance of AED 1,000 per month. This account comes with fixed tenure, allowing you to make regular monthly savings.

Pros

- high interest rates

- Regular monthly savings facility

Cons

- Withdrawal restrictions with fixed tenure

- Minimum balance required

Eligibility Criteria:

Must be a resident of UAE

Maintain monthly minimum balance

7. Currency Passport Savings Account by Emirates NBD

Emirates NBD’s Currency Passport Savings Account is available in various major foreign currencies and carries an interest rate of 0.15%. It has variable minimum balance and is suitable for foreign exchange transactions.

Pros

- Facility to open accounts in different foreign currencies

- No prescribed minimum balance

Cons

- Interest rates are relatively low

- Currency options may be limited

Eligibility Criteria:

Must be a resident of UAE

Present required documents

8. Fixed Deposit Plus by RAKBANK

RAKBANK’s Fixed Deposit Plus offers interest rates ranging from 1.25% to 2.1% and requires a minimum balance of USD 25,000. It offers higher interest rates for longer tenures, making it suitable for customers looking to save for a long time.

Pros

- Higher interest rates for longer periods

- Minimum balance amount is clear

Cons

- Relatively high amount of minimum balance

- Withdrawal restrictions

Eligibility

Must be a resident of UAE

Maintain minimum balance

9. MaxSaver Account by Mashreq Bank

Mashreq Bank’s MaxSaver Account offers an interest rate of 1.2% and no minimum balance requirement. This account allows one transaction per month without penalties, making it a good option for those who make regular transactions.

Pros

- No minimum balance required

- One transaction per month without penalty

Cons

- Interest rates are limited

- Fees may apply on additional transactions

Eligibility Criteria:

Must be a resident of UAE

Submit basic documents for application

10. Active Saver Account by Abu Dhabi Commercial Bank (ADCB)

Abu Dhabi Commercial Bank’s Active Saver Account requires a minimum balance of USD 1,000,000 or AED 10,000,000 and offers interest rates ranging from 0.55% to 1.15%. This account is available in AED, USD and GBP and is suitable for customers with high minimum balances.

Pros

- Highest interest rates for larger deposits

- Facility to open accounts in different currencies

Cons

- High minimum balance requirement

- Not suitable for customers with small balance

Eligibility Criteria:

Must be a resident of UAE

Must meet higher minimum balance

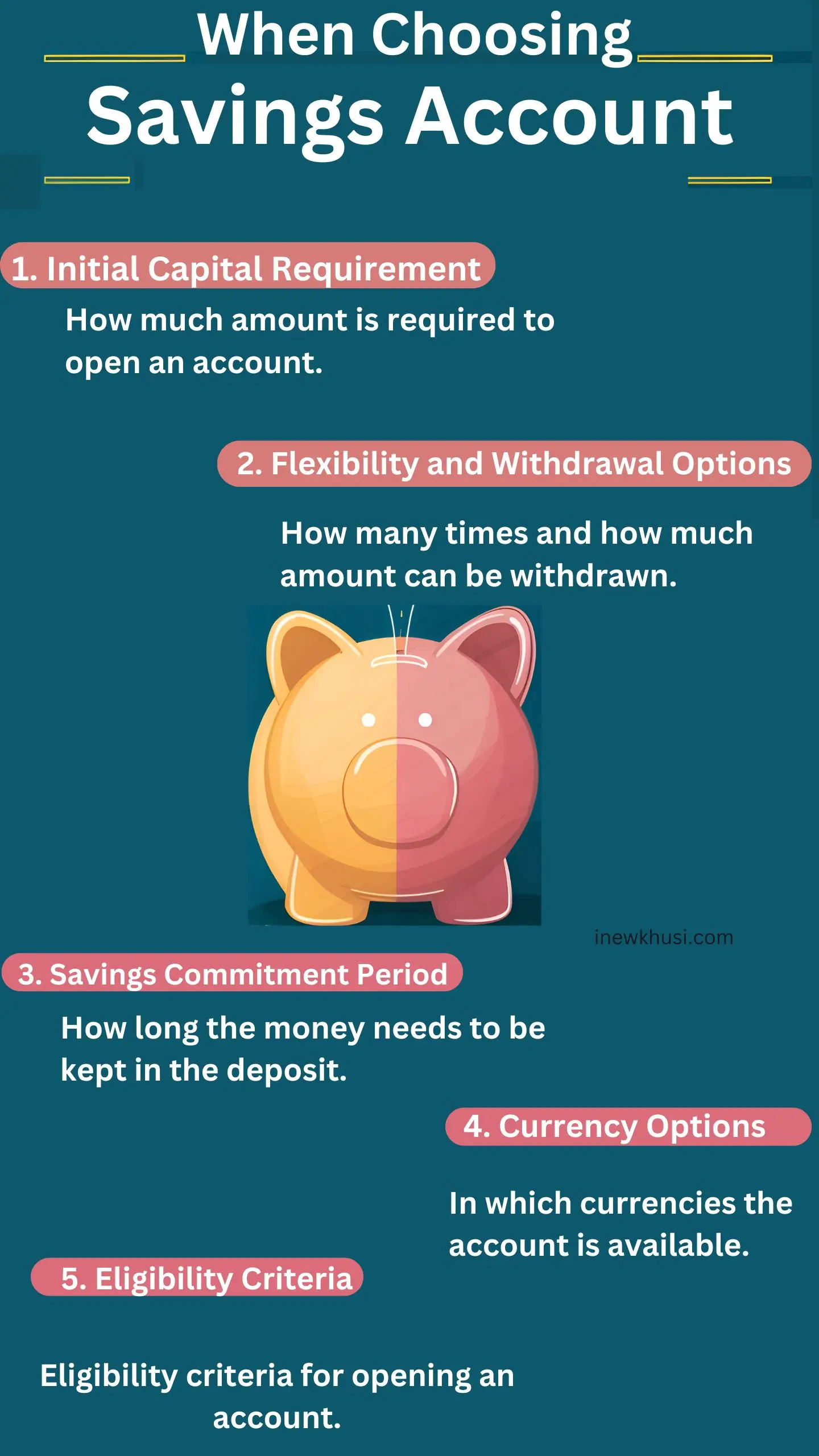

Factors to Consider When Choosing a Savings Account

When you choose a savings account, there are a few key things you should keep in mind. First, see how much money you need to open an account and whether there is any minimum balance requirement.

Secondly, how flexible the account is, i.e. how often and how much amount you can withdraw. Third, some accounts require you to keep the money deposited for a fixed period of time, while others allow this flexibility.

Fourth, if you transact in foreign currencies, check which currencies the account is available in. Fifth, know the eligibility criteria for accounts, such as minimum age and state of residence. And lastly, compare the interest rates of different banks so that you can get the best returns on your savings.

How to Maximize Your Savings Account Benefits

To get the most out of your savings account, there are some simple steps you need to follow. First, make sure your account offers a good interest rate and keep depositing money regularly, so you can get more interest. Additionally, use digital banking tools such as mobile apps so you can easily manage your account and conduct transactions. Finally, to avoid unnecessary fees, make sure there are no hidden fees on your account, such as annual fees or withdrawal fees.

Earn more interest: To get more benefits from your savings account, first make sure that your account is getting a higher interest rate. Choose an account that offers you good interest and also make sure that money is deposited into your account regularly. Making regular deposits will increase your balance and earn more interest.

Make Regular Deposits: Make a habit of depositing money into your account regularly. This will increase your total savings and the interest amount will also be higher. With this habit, your money will increase with time and you will get more benefits.

Use Digital Tools: In today’s digital world, you can easily track your account activities using mobile banking apps. By using these apps, you can easily do transactions, balance checking and other banking tasks, which makes your financial management easier.

Avoid Fees: Before opening your account, ensure that there are no hidden fees such as annual fees or withdrawal charges. These fees can impact your savings, so get all the information you need and choose an account with minimal or no fees.

By following these easy steps, you can get maximum benefit from your savings account and improve your financial condition.

Faq : Top 10 Savings Accounts in the UAE

1. Should I compare interest rates before opening a savings account?

Yes, you can choose the account with the best returns by comparing interest rates.

2. Do all savings accounts have a minimum balance requirement?

No, some accounts do not require a minimum balance, while others may require it.

3. Can I withdraw money from my savings account without any charges?

It depends on the bank’s rules; Some accounts allow free withdrawals while others may have fees.

4. Can a savings account be opened in different currencies?

Yes, many banks provide the facility to open savings accounts in different currencies.

5. Do I need regular deposits for my savings account?

Some accounts require regular deposits, while others do not.

6. How can using digital banking be beneficial?

Digital banking allows you to track your account activities, make transactions and manage it easily.

7. Could there be hidden fees on my savings account?

Yes, some savings accounts may have hidden fees such as annual fees or withdrawal charges, so be fully informed before opening an account.

8. Should I consider liquidity while selecting a savings account?

Yes, liquidity is important as it affects the flexibility of your withdrawals.

9. Can interest rates vary depending on the account type?

Yes, interest rates may differ on different types of accounts, such as fixed deposits and savings accounts.

10. Can I apply for my savings account online?

Yes, many banks provide the facility of online application which makes the process simple.

11. Are there additional features available with any savings account?

Yes, some accounts may include mobile banking, internet banking, and other features.

12. Are there any special eligibility criteria for a savings account?

Yes, some accounts have special eligibility criteria, such as minimum income or other financial qualifications.

13. Can I link my savings account with other banks?

Yes, the facility to link accounts is provided by many banks.

14. Is there any minimum deposit required?

Yes, some banks may have a minimum deposit requirement, while others may not.

15. Can I deposit in foreign currencies in my savings account?

Yes, some banks provide the facility of deposits in foreign currencies.

16. Can I keep money in multiple currencies in the same account?

Yes, some banks provide multi-currency account which allows you to keep money in different currencies.

17. Does the savings account earn regular interest?

Yes, many savings accounts offer regular interest, but its duration and rate may vary according to the bank.

18. Can I set up mobile alerts for my savings account?

Yes, mobile alerts are facilitated by most banks so that you can track account activities.

19. Is there any kind of guarantee for savings account?

There is a government guarantee on the savings account, but to what extent this guarantee is and to what extent it is, it depends on the rules of banks and countries.

Conclusion

When comparing various savings accounts available in UAE, we saw that each bank account has its own distinctive features, which meet different financial needs. For example, the Isave Account of the First Abu Dhabi Bank (Fab) offers high interest rates without minimal balance, while Dubai Islamic Bank (DIB) Wakala Deposits offer outstanding returns for long periods. Abu Dhabi Islamic Bank (Adib) and Rakbank accounts are also popular due to their interest rates and features.

Welcome to our website, Invkhusi.com, where we provide detailed and accurate information after intensive research. Here you get the option to read articles in languages like English, Hindi, Punjabi, Urdu, and Arabic, so that you can get information in your favorite language. For any question or comment, we get answers within 2 hours. Please like and share our post so that others can also get this useful information. Your feedback is always appreciated, and we invite you to visit our website and take advantage of our detailed articles.