Active Saver Online Bank Account in the UAE: If you have gone to Dubai to work or to travel, then it is very important to have a personal savings account. If you have a savings account, it will help in securing your savings.

Abu Dhabi Commercial Bank (ADCB)’s Active Saver Online Bank Account plays an important role in fulfilling these needs because in this bank you can open your savings account online without maintaining balance.

Whether you are starting a new life in Dubai, enjoying a holiday with your family, or working towards your financial goals, this account gives you the opportunity to earn the highest interest rates on your savings, so you can realise your dreams faster.

In this article, we will tell you the complete process of opening an Active Saver Online Bank Account of Abu Dhabi Commercial Bank (ADCB) and will also tell you about the eligibility criteria, necessary documents and the banking facilities available in this account, so stay with us till the end of this article.

Abu Dhabi Commercial Bank Active Saver Saving Account Highlight

There are two types of Active Saver accounts that can be opened in Abu Dhabi Commercial Bank. If you open an AED account, the maximum interest rate you get is 2.25% per annum, whereas if you open a USD account, the maximum interest rate you get is 2.00% per annum. Here we have given information about the highlight points of this account, which are as follows.

AED Account Highlights

| Feature | Description |

|---|---|

| Account Type | AED (Dirham) Account |

| Currency | AED (Dirham) |

| Eligibility | UAE Residents and Non-Residents |

| Minimum Balance Requirement | Typically required; amount may vary |

| Interest Rate | Available on some AED accounts; rate varies |

| Interest Calculation | Depends on the specific account type |

| Access to Funds | Branches, online, and mobile banking |

| ATM/Debit Card | Available |

| Fees | Monthly maintenance fees may apply |

| Opening Deposit | Minimum opening balance required |

| Online Banking | Full access to online and mobile banking services |

| Account Management | Can be managed through ADCB’s internet and mobile banking |

| Additional Features | E-statements, account alerts, fund transfers, direct debits, standing orders |

USD Account Highlights

| Feature | Description |

| Account Type | USD (Dollar) Account |

| Currency | USD (United States Dollar) |

| Eligibility | UAE Residents and Non-Residents |

| Minimum Balance Requirement | Typically required; amount may vary |

| Interest Rate | Available on some USD accounts; rate varies |

| Interest Calculation | Depends on the specific account type |

| Access to Funds | Branches, online, and mobile banking |

| ATM/Debit Card | Available |

| Fees | Monthly maintenance fees may apply |

| Opening Deposit | Minimum opening balance required |

| Online Banking | Full access to online and mobile banking services |

| Account Management | Can be managed through ADCB’s internet and mobile banking |

| Additional Features | E-statements, account alerts, fund transfers, direct debits, standing orders |

Abu Dhabi Commercial Bank Eligibility Criteria

To open your Active Saver Account in Abu Dhabi Commercial Bank, you have to follow the following eligibility criteria which are as follows:

- This account can be opened by UAE citizens and residents holding a valid visa.

- The applicant must be 21 years of age or above.

- To open an Active Saver Account, you must already have an ADCB current or savings account.

- Active Saver Account cannot be opened as a joint account or for a minor.

- You can open this account through internet banking, mobile application and its official website.

Abu Dhabi Commercial Bank Necessary DOCUMENTS

The documents required to open an Abu Dhabi Commercial Bank Active Saver Account are as follows:

- Identification: Valid passport and visa (for expatriates) or Emirates ID (for UAE residents).

- Employment Proof: Salary certificate or employment letter (if applicable).

- Proof of Residence: Utility bill, tenancy contract, or other proof of UAE address.

- Banking Reference: Reference letter from another bank (if requested by ADCB).

- Account Opening Form: Completed ADCB account opening application form.

- Photographs: Passport-size photographs (usually two).

- Initial Deposit: Required initial deposit amount (if applicable).

These documents are required to verify your identity, address, and employment status, and to comply with banking regulations. Requirements may vary, so it’s best to confirm with ADCB or visit their website for the most accurate and up-to-date information.

Also Read: Mashreq Easy Saver Account Opening Online

Abu Dhabi Commercial Bank Benefits and Features

If you open this bank account, then this bank account will provide you with many benefits. The main features of this bank account are as follows:

- Quick Account Opening: Open an Active Saver Account in just a few minutes through ADCB Personal Internet Banking.

- Daily Interest Calculation: Interest is calculated daily and paid monthly.

- Multi-Currency: This account is available in AED, USD, and GBP.

- Fund Transfer & Bill Payment: Credit Card Bill Payments, Fund Transfers, and TouchPoints Redemption.

- Online Access: 24/7 online access, allowing you to manage your savings even outside your working hours.

- Easy Transfers: Transferring funds to an Active Saver Account is just a click away.

ADCB Active Saver Account Opening Process

The process of opening an Active Saver Account in Abu Dhabi Commercial Bank is quite easy. You can open this savings account online through internet banking or by using a mobile application. Apart from this, you can also open your savings account by logging on to its official website. To open an account, the below mentioned step by step process can be followed:

Open your bank account through Internet Banking

1. Login to ADCB Personal Internet Banking**

2. Click on ‘Open New Account‘ in the navigation bar on the left.

3. Select ‘Active Saver AED’ or ‘Active Saver USD‘ from the drop box.

4. Complete the online Active Saver application form.

5. This will generate your account number online.

| Official Site | ADCB Site Link |

Open your savings account from the official website

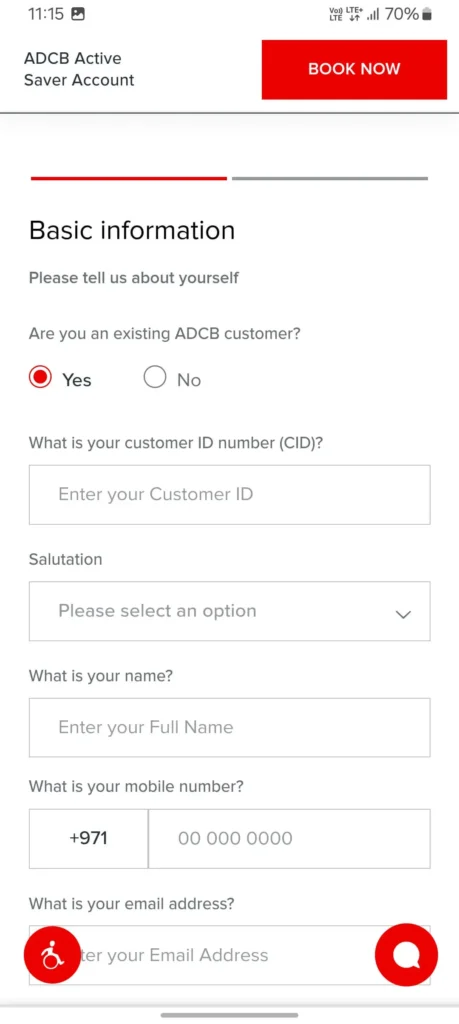

Step1. First of all open the official website of ADCB Bank in your device.

Step2. Select ADCB Active Saver Account from the menu area.

Step3. After this click on the Book Now option.

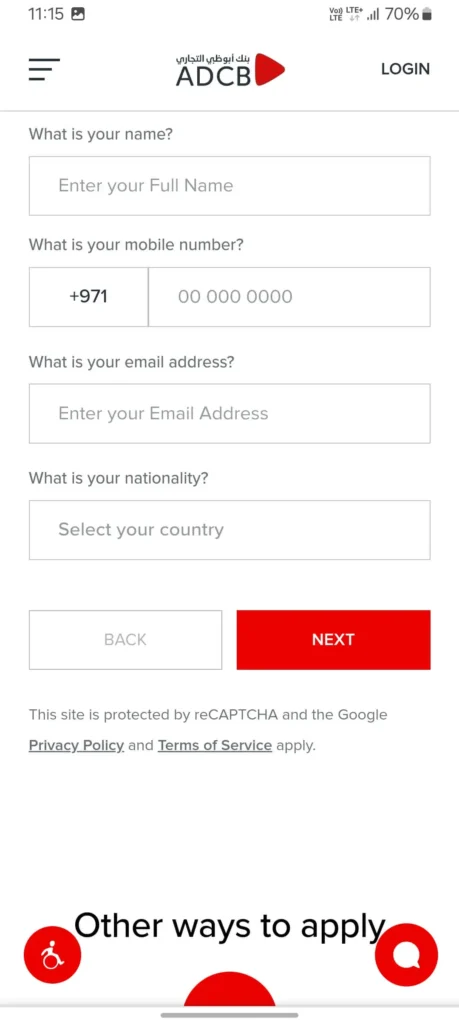

Step4. Now an application form will appear where after filling your personal information like your name, mobile number, email ID, name of your country, click on the Next button.

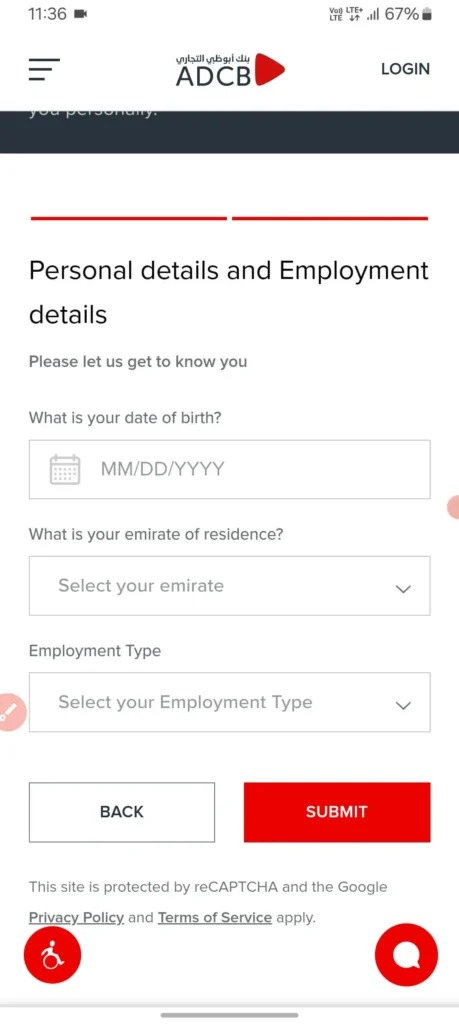

Step5. After this a new page will open where fill your date of birth, your Emirates, employment type, company name monthly salary.

Step6. After filling all the information, submit this application form.

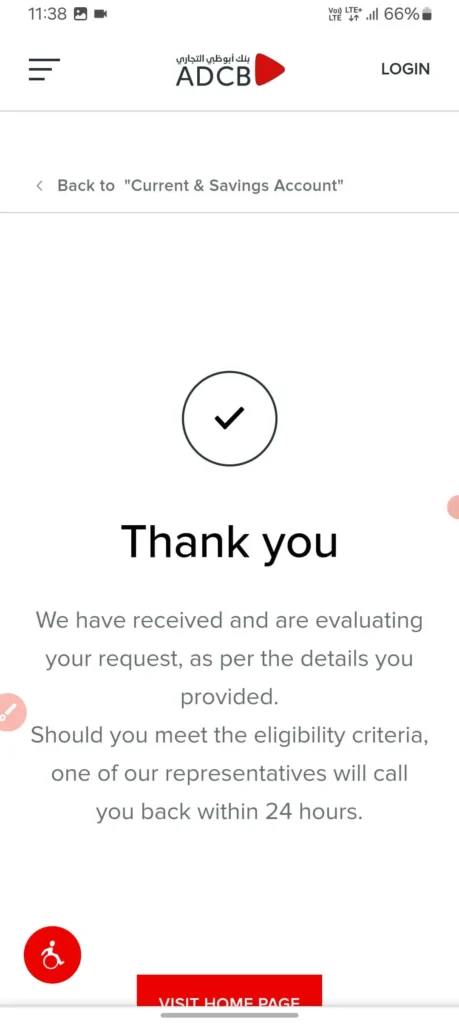

Step7. After the application form is submitted, a Thank You message will appear, after 24 hours your eligibility will be checked and the executives of this bank will contact you and open your bank account.

In this way you can easily open your savings account, I hope you will be able to open your savings account by following this process.

Frequently Asked Questions (FAQs)

Q. 1. Is there any monthly charge on Active Saver Account?

Ans. Yes, monthly charge will be applicable if the respective segment-wise relationship balance criteria is not met.

Q. 2. Can I open Active Saver Account as a joint account?

Ans. No, Active Saver Account cannot be opened as a joint account.

Q. 3. Can this account be opened for minors?

Ans. No, this account cannot be opened for minors.

Q. 4. Can I open my Active Saver Account in other currencies?

Ans. Yes, this account is available in AED, USD and GBP.

Q. 5. Is interest on deposits in Active Saver Account calculated on a daily basis?

Ans. Yes, interest is calculated on a daily basis and paid monthly.

Conclusion

The ADCB Active Saver Account is a simple and convenient solution that offers the highest interest rates on your savings. It is easy to open and manage online, and its many features make it an attractive option. Open an ADCB Active Saver Account today to improve your savings and achieve your financial goals faster.