There are many types of banks in the United Arab Emirates (UAE) that cater to the different needs of people. There are more than 50 Banks actively providing their Banking Services here, which include National, International, Islamic, Commercial, and Special Status Banks. These banks provide a wide range of financial services to local and global customers, including opening savings accounts, opening current accounts, personal loans, credit cards, digital banking, and investments.

UAE’s banking system is very strong and transparent, due to which people feel safe with their money. In this article we will know the list of banks present in UAE and about them in detail.

Here, information will be given about all the banks present in UAE which are currently providing banking services in any way, so you have to read this article with us till the end.

| Summary:- 1. Banking Structure: There are approximately 51 banks in the UAE, including 22 local and 29 foreign banks. 2. Strict regulations: Banking activities are monitored by the Central Bank of UAE. 3. Islamic Banking: UAE also includes banks providing Islamic banking services. 4. Competitive Industry: The UAE’s banking sector is very competitive and diverse. 5. International Attraction: The UAE is an attractive banking destination for foreign investors. |

Importance of banking sector in UAE

As I told you above, the banking system of UAE is very strong and transparent, due to this it provides strength and stability to the economy of UAE. There are many national and international banks that provide safe and reliable services to the customers, such as current accounts, savings accounts, business loans, investment opportunities.

Through the banking sector, people and businesses can easily manage their financial transactions, thereby promoting economic activities. In addition, UAE banks also provide digital banking services, allowing people to operate their accounts anytime and anywhere. All these facilities and services together make the banking sector of UAE very important.

Presence of national and international banks

The presence of national and international banks in the UAE is very important and plays a big role in the financial stability and development of the country. National banks, such as Abu Dhabi Commercial Bank, Dubai Islamic Bank and First Abu Dhabi Bank, provide Specialized Services to local residents and Businesses in the UAE. Through these, people can keep their money safe, take loan when needed and achieve their financial goals.

On the other hand, the UAE also has several major international banks, such as HSBC, Citibank, and Standard Chartered Bank. These banks provide their services globally and promote international trade and investment.

The presence of international banks gives the UAE an important place on the global financial map and further strengthens the country’s economy. These banks provide international transactions, foreign exchange services, and international investment opportunities, helping local businesses expand into global markets.

The combined presence of national and international banks has made the UAE’s banking sector very diverse and strong. This not only benefits local residents and businesses, but it also helps the UAE become a global financial hub.

The services and facilities of these banks together promote the UAE’s Economic Growth and lead the country towards a stable and prosperous financial future.

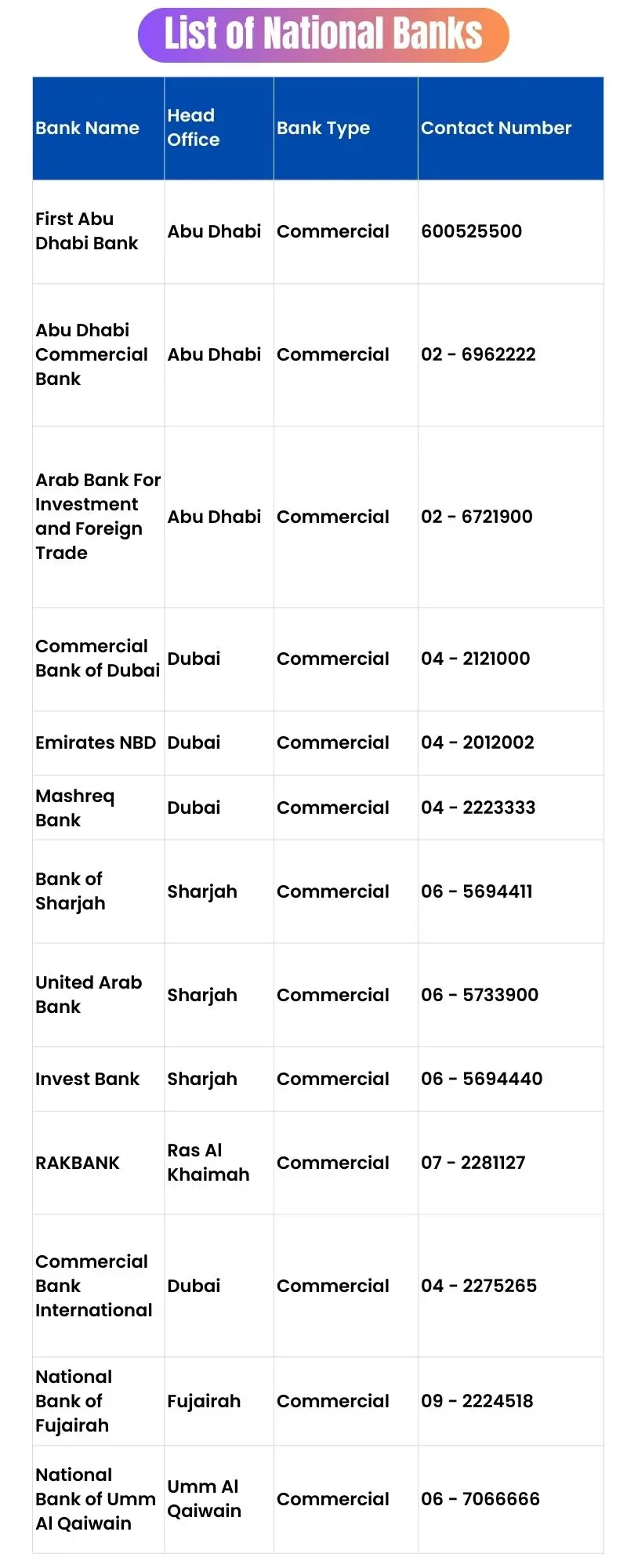

List of Commercial Banks in UAE

The UAE has a wide and diverse list of Commercial banks that underpin the country’s financial system. Prominent names among these banks include Abu Dhabi Commercial Bank (ADCB) and First Abu Dhabi Bank (FAB), which are based in Abu Dhabi and listed on the ADX stock exchange.

Other important commercial banks include Bank of Sharjah (BOS), United Arab Bank (UAB), and Invest Bank (INVEST), which are based in Sharjah and listed on the ADX stock exchange.

Major commercial banks based in Dubai include Commercial Bank of Dubai (CBD), Mashrekh Bank (MASQ), and Emirates NBD (ENDB), which are listed on the DFM stock exchange.

Ras Al Khaimah National Bank (RAKBANK) of Ras Al Khaimah is also an important commercial bank. This diversity not only ensures the financial stability of the UAE but also provides customers with the convenience of availing various banking services.

Commercial Banks In UAE

In the table below, I have given a complete list of commercial banks. Here the name of the bank, headquarters, type of bank, stock code are mentioned, to know more you can see the table given below:

| Bank Name | Headquarters | Stock Code |

|---|---|---|

| Abu Dhabi Commercial Bank | Abu Dhabi | ADX: ADCB |

| First Abu Dhabi Bank | Abu Dhabi | ADX: FAB |

| Al Masraf Arab Bank for Investment & Foreign Trade | Abu Dhabi | None |

| Al Hilal Bank | Abu Dhabi | Acquired by ADCB Group |

| Bank of Sharjah | Sharjah | ADX: BOS |

| United Arab Bank | Sharjah | ADX: UAB |

| Invest Bank | Sharjah | ADX: INVEST |

| Commercial Bank International | Ras Al Khaimah | ADX: CBI |

| National Bank of Fujairah | Fujairah | ADX: NBF |

| Commercial Bank of Dubai | Dubai | DFM: CBD |

| Mashreq Bank | Dubai | DFM: MASQ |

| Emirates NBD | Dubai | DFM: ENDB |

| Dubai Finance Bank | Dubai | None |

| National Bank of Ras Al Khaimah (RAKBANK) | Ras Al Khaimah | ADX: RAKBANK |

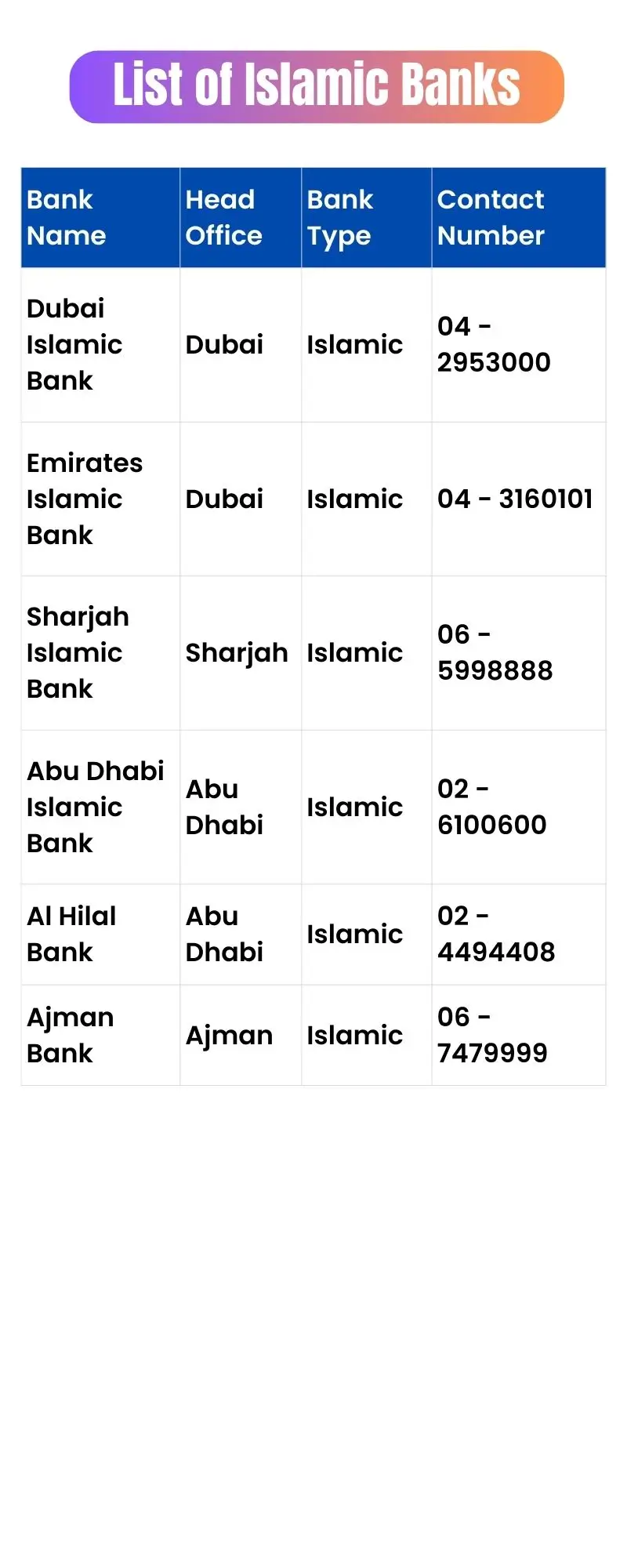

List of Islamic Banks in UAE

There is a distinct and important category of Islamic banks in the UAE that deliver Shariah-based financial services. Major Islamic banks include Abu Dhabi Islamic Bank (ADIB), Dubai Islamic Bank (DIB), Emirates Islamic (EIB), and Sharjah Islamic Bank (SIB).

Abu Dhabi Islamic Bank is based in Abu Dhabi and is listed on the ADX stock exchange, while Dubai Islamic Bank is based in Dubai and is listed on the DFM stock exchange. Emirates Islamic is also based in Dubai and listed on the DFM.

Sharjah Islamic Bank is based in Sharjah and is listed on the ADX. Noor Bank, which has been acquired by Dubai Islamic Bank, is another important bank in this category. These banks provide their services in accordance with Sharia laws, assuring customers of an ethical and transparent financial experience.

Islamic Banks In UAE

A complete list of Islamic banks is given in the table below. Here the name of the bank, headquarters, type of bank, stock code are mentioned, to know more you can see the table given below:

| Bank Name | Headquarters | Bank Type | Stock Code |

|---|---|---|---|

| Abu Dhabi Islamic Bank | Abu Dhabi | Islamic | ADX: ADIB |

| Dubai Islamic Bank | Dubai | Islamic | DFM: DIB |

| Emirates Islamic | Dubai | Islamic | DFM: EIB |

| Sharjah Islamic Bank | Sharjah | Islamic | ADX: SIB |

| Noor Bank | Dubai | Islamic | Acquired by Dubai Islamic Bank |

List of Private Banks in UAE

There is a significant range of private banks in the UAE, which provide specialized and personalized banking services. This includes major banks such as Al Masraf Arab Bank for Investment and Foreign Trade and Al Hilal Bank, which are based in Abu Dhabi. Al Hilal Bank has been acquired by ADCB Group. Other private banks such as Dubai Finance Bank and Network International also have significant market presence.

International financial companies such as MasterCard and Visa are also involved in the financial scene here, although they do not provide direct banking services. In addition, new banks such as Zand Bank and Vio Bank and specialized financial institutions such as Afaq Islamic Finance also fall into this category, providing a variety of personal and investment services.

These banks offer high quality customer service and innovative financial solutions that help meet the specific needs of customers.

Private Banks In UAE

A complete list of private banks is given in the table below. Here the name of the bank, headquarters, type of bank, stock code are mentioned, to know more you can see the table given below:

| Bank Name | Headquarters | Bank Type | Stock Code |

|---|---|---|---|

| Al Maryah Community Bank | Abu Dhabi | Private | None |

| Al Masraf Arab Bank for Investment & Foreign Trade | Abu Dhabi | Private | None |

| Dubai Finance Bank | Dubai | Private | None |

| Dubai Bank | Dubai | Private | Acquired by Emirates Islamic |

List of Investment Banks in UAE

The category of investment banks in the UAE includes major institutions that typically specialize in financial investment and management services. One of the major banks is Emirates Investment Bank, headquartered in Dubai and listed under the stock code of DFM: EIBANK. The bank provides investment management, capital structure advice and other financial services.

Another important institution is Invest Bank, headquartered in Sharjah and listed under the ADX:INVEST stock code. Invest Bank also offers various investment-related services, such as risk management and financial advice.

Both banks play important roles in the UAE’s financial sector, helping customers achieve their investment plans and financial goals.

Investment Banks In UAE

A complete list of investment banks is given in the table below. Here the name of the bank, headquarters, type of bank, stock code are mentioned, to know more you can see the table given below:

Here’s the table in English:

| Bank Name | Headquarters | Stock Code |

|---|---|---|

| Emirates Investment Bank | Dubai | DFM: EIBANK |

| Invest Bank | Sharjah | ADX: INVEST |

List of Banks by Type

The banking sector in the UAE is rich with a wide variety of banking organizations that provide various banking services and facilities. The list of national banks includes commercial banks, such as Abu Dhabi Commercial Bank and Emirates NBD, which offer a wide range of financial services. Additionally, the category of Islamic banks includes institutions such as Abu Dhabi Islamic Bank and Dubai Islamic Bank, which focus on Shariah-compliant services.

The list of banks with special status includes institutions that are known for specific or unique services, such as Mastercard and Network International.The category of international banks, includes many leading global banks such as HSBC and Citibank, which along with their global presence also provide services in UAE.

Asian banks have a presence of Chinese, Indian and Japanese banks, such as Bank of China and Bank of Baroda, which provide financial solutions linked to Asia.

The list of US banks includes major banks such as American Express Bank and Deutsche Bank, which also offer their services in the UAE.

The variety and characteristics of all these banks make the UAE banking system a rich and versatile network, capable of meeting the financial needs of customers.

List of National Banks

A complete list of national banks is given in the table below. Here the name of the bank, headquarters, type of bank, contact number are mentioned, to know more you can see the table given below:

Islamic Banks

A complete list of Islamic banks is given in the table below. Here the name of the bank, headquarters, type of bank, contact number are mentioned, to know more you can see the table given below:

List of International Banks

A complete list of international banks is given in the table below. Here the name of the bank, headquarters, type of bank, contact number are mentioned, to know more you can see the table given below:

| Bank Name | Headquarter | Headquarter in UAE | Stock Code | Contact Number |

|---|---|---|---|---|

| National Bank of Bahrain | Manama, Bahrain | Abu Dhabi | BSB: NBBR | 00971-26902222 |

| Rafidain Bank | Baghdad, Iraq | Abu Dhabi | – | – |

| Arab Bank | Amman, Jordan | Abu Dhabi | ASE: ARBK | 04-4450000 |

| Banque Misr | Cairo, Egypt | Dubai | – | 02 – 6273000 |

| El Nilein Bank | Abu Dhabi | Abu Dhabi | – | 02 – 6269995 |

| National Bank of Oman | Muscat, Oman | Abu Dhabi | MSX: NBO | – |

| Credit Agricole | Montrouge, France | Dubai | – | 04 – 3314211 |

| Bank of Baroda | Vadodara, India | Dubai | NSE: BANKBARODA | 04 – 3136699 |

| BNP Paribas | Paris, France | Abu Dhabi | – | 02 – 6130400 |

| Janata Bank Limited | Dhaka, Bangladesh | Abu Dhabi | – | – |

| HSBC Bank Middle East Limited | London, UK | Dubai | LSE: HSBA, NYSE: HSBC | 04 – 4235168 |

| Arab African International Bank | Cairo, Egypt | Dubai | – | 04 – 3937773 |

| Al Khaliji | Doha, Qatar | Dubai | – | 04 – 2222291 |

| Al Ahli Bank of Kuwait | Kuwait City, Kuwait | Dubai | – | 04 – 6075555 |

| Habib Bank Ltd. | Karachi, Pakistan | Dubai | PSX: HBL | 04 – 3029111 |

| Habib Bank A.G Zurich | Zurich, Switzerland | Dubai | – | 04 – 2607999 |

| Standard Chartered Bank | London, UK | Dubai | LSE: Stan | 04 – 3520455 |

| Citibank N.A. | New York, America | Dubai | NYSE: C | 04 – 3245000 |

| Bank Saderat Iran | Tehran, Iran | Dubai | TSE: BSDR1 | 04 – 6035284 |

| Bank Melli Iran | Tehran, Iran | Dubai | TSE: BANK1 | 04 – 2015220 |

| Banque Banorrent France | Paris, France | Dubai | – | 04 – 2284655 |

| NatWest Markets Plc | London, UK | Dubai | – | – |

| United Bank Ltd. | Karachi, Pakistan | Dubai | PSX: UBL | 04 – 3296013 |

| Doha Bank | Doha, Qatar | Dubai | – | 04 – 3439111 |

| Saudi National Bank | Jeddah, Saudi Arabia | Dubai | Tadawul: SNB | 04 – 7091111 |

| National Bank of Kuwait | Kuwait City, Kuwait | Dubai | – | 04 – 2929222 |

| BOK International Bank | Khartoum, Sudan | Abu Dhabi | – | 02 – 3041777 |

| American Express Bank | Buffalo, America | Abu Dhabi | NYSE: AXP | 800-0444-3895 |

| Deutsche Bank AG | Frankfurt, Germany | Abu Dhabi | – | 04 – 3611700 |

| KEB Hana Bank | Seoul, South Korea | Abu Dhabi | – | 02 – 4498606 |

| Barclays Bank Plc | London, UK | Abu Dhabi | – | 02 – 4958300 |

| Bank of China Limited | Beijing, China | Abu Dhabi | – | 02 – 4041666 |

| Gulf International Bank | Manama, Bahrain | Abu Dhabi | – | 026318080 |

| MCB Bank Limited | Lahore, Pakistan | Dubai | PSX: MCB | 04 – 3029111 |

| Intesa Sanpaolo S.p.A. | Turin, Italy | Abu Dhabi | – | – |

| Agricultural Bank of China Ltd. | Beijing, China | Dubai | – | – |

| Bank Alfalah Limited | Karachi, Pakistan | Dubai | – | – |

List of Asian Banks (Asian Banks)

A complete list of Asian banks in the table below is given here, the bank’s name, headquarters, the type of the bank, the contact number, you can see the table below to know more:

| Bank Name | Headquarters | Stock Code | Contact Number at Headquarters UAE |

|---|---|---|---|

| Bank of Baroda | Vadodara, Bharat | NSE: Bankbaroda | 04 – 3136699 |

| National Bank of Oman | Muscat, Oman | MSX: NBO | – |

| Industrial and Commercial Bank of China | Beijing, China | – | 02 – 4498606 |

| Agricultural Bank of China Ltd. | Beijing, China | – | – |

| Bank Alfalah Limited | Karachi, Pakistan | – | – |

| MCB Bank Limited | Lahore, Pakistan | PSX: MCB | 04 – 3029111 |

| Habib Bank Limited | Karachi, Pakistan | PSX: HBL | 04 – 3029111 |

| Habib Bank A.G Zurich | Zurich, Switzerland | – | 04 – 2607999 |

| Doha Bank | Doha, Qatar | – | 04 – 3439111 |

| Al Ahli Bank of Kuwait | Kuwait City, Kuwait | – | 04 – 6075555 |

| Bank Saderat Iran | Tehran, Iran | TSE: BSDR1 | 04 – 6035284 |

| Bank Melli Iran | Tehran, Iran | TSE: Bank1 | 04 – 2015220 |

| United Bank Ltd. | Karachi, Pakistan | PSX: UBL | 04 – 3296013 |

| KEB Hana Bank | Seoul, South Korea | – | 02 – 4498606 |

List of American banks (American Banks)

Below is a complete list of American banks in the table, here the bank’s name, headquarters, the type of the bank, the contact number, you can see the table below to know more:

| Bank Name | Headquarters | Stock Code | Contact Number at Headquarters UAE |

|---|---|---|---|

| Citibank N.A. | New York, America | NYSE: C | 04 – 3245000 |

| American Express Bank | Buffalo, America | NYSE: AXP | 800-0444-3895 |

| HSBC Bank Middle East Limited | London, UK | LSE: HSBA, NYSE: HSBC | 04 – 4235168 |

| Bank of America | Charlotte, America | – | – |

| JPMorgan Chase | New York, America | – | – |

Special status banks

There are also some special conditions inside Dubai, this bank also provides its banking services inside Dubai. A complete list of banks with special status is given in the table.

Here, the bank’s name, headquarters, bank type, contact number are told, to know more, you can see the table below:

| Bank’s Name | Headquarters | Contact Number at Headquarters UAE |

|---|---|---|

| Emirates Investment Bank | Dubai | 04 – 23177777 |

| Network International | Dubai | 04 – 3032431 |

| Mastercard | Abu Dhabi | 800-0444-3895 |

| Visa | Dubai | 1-800-847-2911 |

| Al Maryah Community Bank | Abu Dhabi | +971 600 571 111 |

| Wio Bank | Abu Dhabi | – |

| Zand Bank | Dubai | – |

| Aafaq Islamic Finance | Dubai | – |

Banking services and facilities

Inside the UAE, you are opening your savings account in any bank, so all the banks give you many types of banking service and facility here.

Here I have given the banks inside the UAE after opening the bank. Told about which is as follows:

- Types of Accounts: Inside the UAE, you can open many types of bank accounts, here I have told you about all the bank accounts that you can easily open online or you can open your nearest branch and get it open.

- Checking Account: Useful for daily transactions, in which check books and ATM cards are available. This account helps to check the balance and transfer funds.

- Savings Account: Useful for earning interest, where customers get some interest safe as well as some interest.

- Fixed Deposit: Scheme that receives high interest rate on depositing money for a fixed period. In this account, money is locked for a fixed time.

- Employee Savings Scheme (Employee Savings Plan): Savings schemes provided by companies especially for their employees.

- Loan and Credit Services

- Personal Loan: Loans for personal expenses such as marriage, travel, or education. This loan is usually provided without a guarantee without any property.

- Home Loan: Loan to buy or build a house. It usually contains long -term interest rates.

- Auto Loan: Loans to buy a vehicle, in which the vehicle is kept as a safety of loan.

- Credit Card: A card providing credit for daily purchases, in which the bill for the money spent is to be repaid at the end of the month.

- Digital Banking

- Net Banking: Use of monitoring, transactions, and other banking services through the Internet. This facility is available 24/7.

- Mobile Banking: Use of banking services through smartphone apps. This includes checking, transfer, and bill payments.

- E-wallets: Online payment and transfer facilities using digital wallets. These wallets protect your banking information.

- Investment Services

- Stocks and Share Investments: Earning profit by investing in shares of various companies. Investment advice and facilities are provided in the stock market through banks.

- Mutual Funds: Investment plans run by professional managers, which invest in a variety of shares, bonds, and other assets.

- Bonds: Investment in government or corporate bonds, which pay at a fixed interest rate. These investments are long -term safe options.

- Real Estate Investment: Investment in Real Estate Property, such as residential or business assets.

All these services and features make the banking system wider and useful for customers, allowing them to easily meet their financial needs.

Future of Banking in UAE in UAE

Keeping the middle eye of how the future of banking in UAE can be, I have given information below inside some points which is as follows:

- Technological Advancements

The direction of the banking sector in the UAE is moving towards rapid technological progress. Artificial Intelligence (AI) and Machine Learning (ML) are being used to promote personal financial advice and automated services for customers. Blockchain technology, which makes transactions safe and transparent, is being adopted by banks to improve security and transparency. Also, digital banking services such as mobile banking apps and virtual banks have made banking for customers more convenient and accessible. With these technological innovations, the banking sector of the UAE will be more smart and interconnected in the future, which will provide better experience to customers and more secure services.

- Government Policies

The UAE government has launched several policies and initiatives to encourage innovation and development in the banking sector. The central bank has made various schemes to promote digital payments and electronic transactions. Initiatives like the government’s “VIM 2021” and “Digital Banking Roadmap” are focused on modernizing banking services and encouraging fintech companies. In addition, the UAE government has implemented strong data security and privacy laws, which ensure safety of customers’ information and increase confidence in banking.

- International partnerships

The UAE banking sector is integrated with the global banking system through international partnerships. The country’s banks are in partnership with global financial institutions, fintech companies, and credit card companies to offer new technical solutions and services. The local banking sector is being maintained in line with international standards with the presence of international banks in the UAE and cooperation with foreign banks. This global approach is helping UAE to establish itself as a major financial hub and attract foreign investors.

With these technological progress, government policies, and international partnerships, UAE’s banking sector will become more advanced, safe, and customer-centered in the future.

FAQ: List of Banks in the United Arab Emirates

1. How many banks are there in UAE and how many of them are local and foreigners?

The UAE has a total of 47 banks, out of which 21 are local banks and 26 foreign banks.

2. Who monitors banking activities in UAE?

The UAE Central Bank monitors all banking activities in the country.

3. Islamic banking services which banks provide in UAE?

The UAE has 8 Islamic banks that provide Islamic banking services.

4. How competitive is the banking sector of UAE?

The UAE banking sector is quite competitive, with both local and foreign banks participation.

5. What is the importance of banking for foreign investors in UAE?

The UAE banking sector offers foreign investors several investment opportunities, and the services of banks here are important for foreign investors.

Conclusion

The banking sector of the UAE is a rich and diverse sector operated by a combination of local and international banks. This includes a wide range of banks with commercial, Islamic, and special status. Various categories of banking services, such as Accounts, Loans, Credit, Digital Banking, and Investment Services, meet the various financial needs of customers.

Improvements in the direction of technological progress and government policies are making the UAE banking sector more modern and customer-focused.

Banking services not only facilitates financial transactions, but also create a stable and safe financial environment. Various categories of accounts, loans and credit services, digital banking and investment services not only allow customers to protect their money, but also help them to achieve their financial goals.

These services play an important role in economic development, financial stability, and personal prosperity. Customers are advised to take maximum advantage of banking services to select banking products and services based on their personal financial needs and goals.

They can make their transactions convenient and safe by using digital banking facilities. Also, they can strengthen their financial position by using loans and credit services properly.

Finally, a strong financial plan and review of regular banking services will help customers make better financial decisions and make their financial future safe.