If you are a new customer of Mashreq Bank, you can take this loan for any of your financial needs, whether you want to pay for education, plan your next vacation, or renovate your home. Mashreq Bank’s personal loan is a great option to fulfill all your needs.

In this post, we will explain the complete process of taking a personal loan for new customers from Mashreq Bank, including the eligibility criteria, benefits, necessary documents, and other related information about this loan.

Mashreq Bank Personal Loan for New Customers Details

Mashreq personal loan offers instant online approval, enabling you to fulfill your dreams within 5 minutes. You can obtain a loan of up to 20 times your salary and up to AED 1 million. The loan provided by this bank comes with very low interest rates, and you can benefit from a 90 day period for the first EMI.

Mashreq personal loan comes with an easy online process, high loan amount, quick approval, and fast disbursement. If you are a UAE resident with an income of AED 5,000 or more, you are eligible for this loan. We have provided complete information about this loan here, so stay with us until the end.

Mashreq Bank Personal Loan for New Customers Overview

If you are a new customer of Mashreq Bank, you can get the fastest loan from this bank. The loan application process is online, so you don’t need to visit a branch. Below is a table that provides a complete overview of this loan:

| Parameter | Details |

|---|---|

| Bank Name | Mashreq Bank |

| Loan Type | Personal Loan |

| Loan Purpose | ● Education ● Holiday Planning ● Home Renovation |

| Loan Amount | Up to 20x salary, max AED 1 million |

| Approval Time | Instant online approval in 5 minutes |

| Interest Rates | Low interest rates |

| EMI Deferral | 1st EMI deferral period up to 90 days |

| Eligibility Criteria | ● UAE resident, Minimum age: 21 years ● Minimum salary: AED 5,000 ● Salary transfer required |

| Required Documents | Valid Passport with UAE residence visa page, Valid Emirates ID |

| Employment Term | Confirmed employee or minimum 6 months at current company |

| Salary Transfer Letter | ● Required from employer, ● Mentioning Mashreq salary transfer account number |

| Security Cheque | ● Mashreq-issued cheque, payable to Mashreq Bank ● Loan amount in words and digits, signed |

| Documentation | Minimal documents via Mashreq salary transfer account |

| Loan Calculator | Available on the website |

| Additional Benefits | ● Convenient online process ● Fast payout time |

Benefits

Mashreq Bank Personal Loan comes with numerous benefits. Below are all the advantages you receive after taking this loan:

- Convenient Process: Easy and convenient online loan application process

- Instant Online Approval: Get approval for your loan application in just 5 minutes.High Loan Amounts: Avail loans up to 20 times your salary, with a maximum limit of AED 1 million.Low Interest Rates: Enjoy competitive and low interest rates on your loan.

- Eligibility for Various Employment Types: Both employees of approved and unapproved companies can apply.

- EMI Deferral: Benefit from a first EMI deferral period of up to 90 days.

- Flexible Use: Use the loan for various purposes such as education, holiday planning, or home renovation.

- Fast Payout: Quick disbursement of loan amounts after approval.

- Easy Documentation: Minimal documentation required, submitted through your Mashreq salary transfer account.

- Digital Loan Services: Access to digital loan services, including loan calculators and online documentation submission.

Eligibility Criteria

Here are the eligibility criteria for availing a Mashreq Personal Loan for New Customers:

1. Residency: Must be a resident of the UAE.

2. Age: Must be at least 21 years old.

3. Minimum Salary :

- AED 5,000 per month for employees of approved companies.

- AED 10,000 per month for employees of unapproved companies.

4. Employment Status:

- Must be a confirmed employee.

- Alternatively, must have a length of service of 6 months or more at the current company.

5. Salary Transfer Requirement:

- Must transfer your salary to a Mashreq Bank account.

- The salary transfer letter from your employer should include your Mashreq salary transfer account number.

6. Security Cheque : Required to provide a security cheque from a Mashreq-issued cheque book, filled out as specified by the bank.

These criteria must be met to be eligible for a personal loan from Mashreq Bank.

Required Documents

Here are the required documents for availing a Mashreq Personal Loan for New Customers:

1. Valid Passport with UAE Residence Visa Page: Ensure your passport is current and includes the page with your UAE residence visa.

2. Valid Emirates ID: A current Emirates ID is necessary for the loan application.

3. Salary Transfer Letter: Issued by your employer, stating your Mashreq salary transfer account number and confirming the transfer of your salary to Mashreq until the loan is fully repaid.

4. Security Cheque : A Mashreq-issued cheque, filled out with the loan amount in words and digits, signed, and payable to Mashreq Bank (leave the cheque undated).

These documents should be prepared and submitted through your Mashreq salary transfer account to complete the loan application process.

How to Apply for Mashreq Bank Personal Loan for New Customers

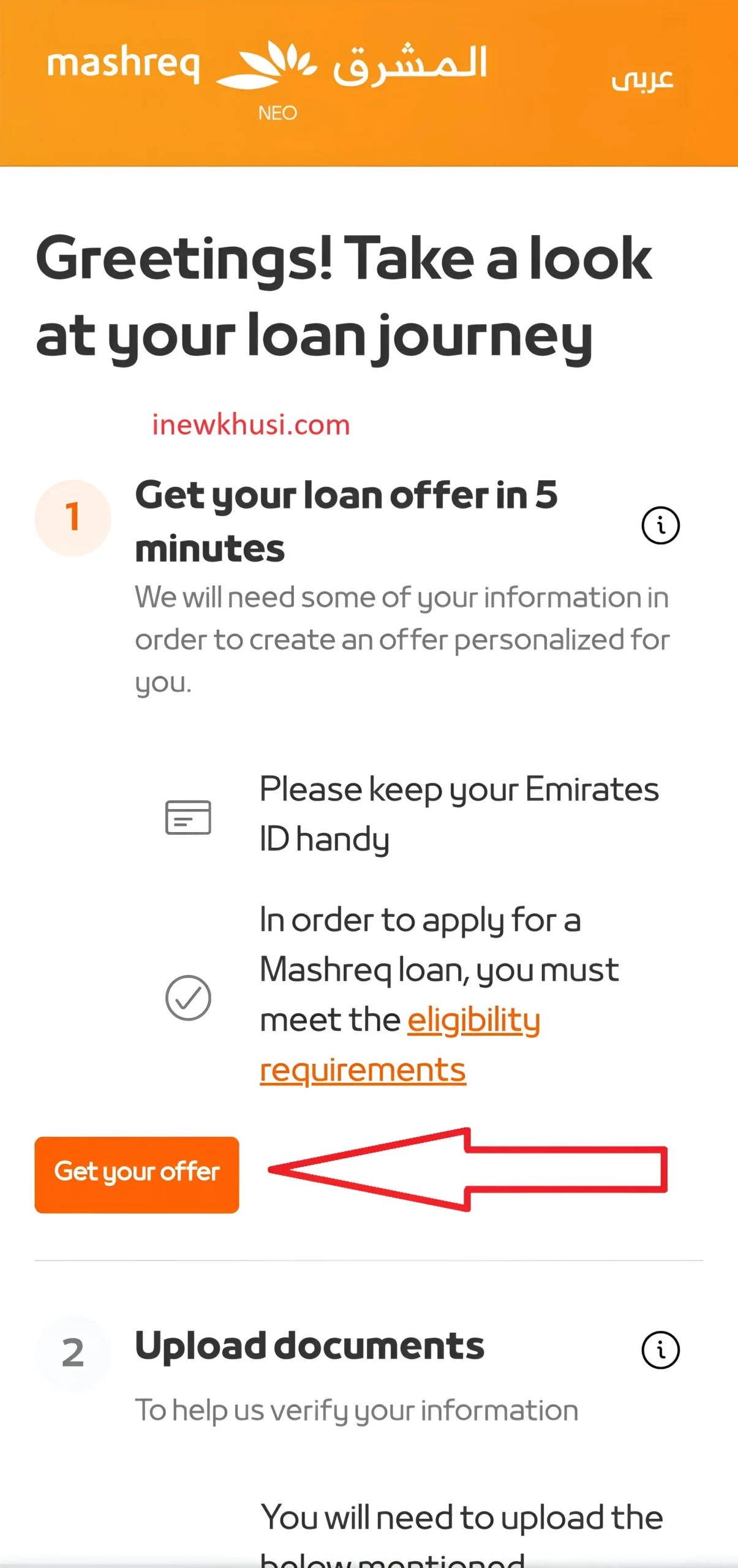

After reading the information for new customers, here is the step-by-step process for new customers to apply for a Mashreq Bank personal loan:

1. Open the Mashreq Bank Website:

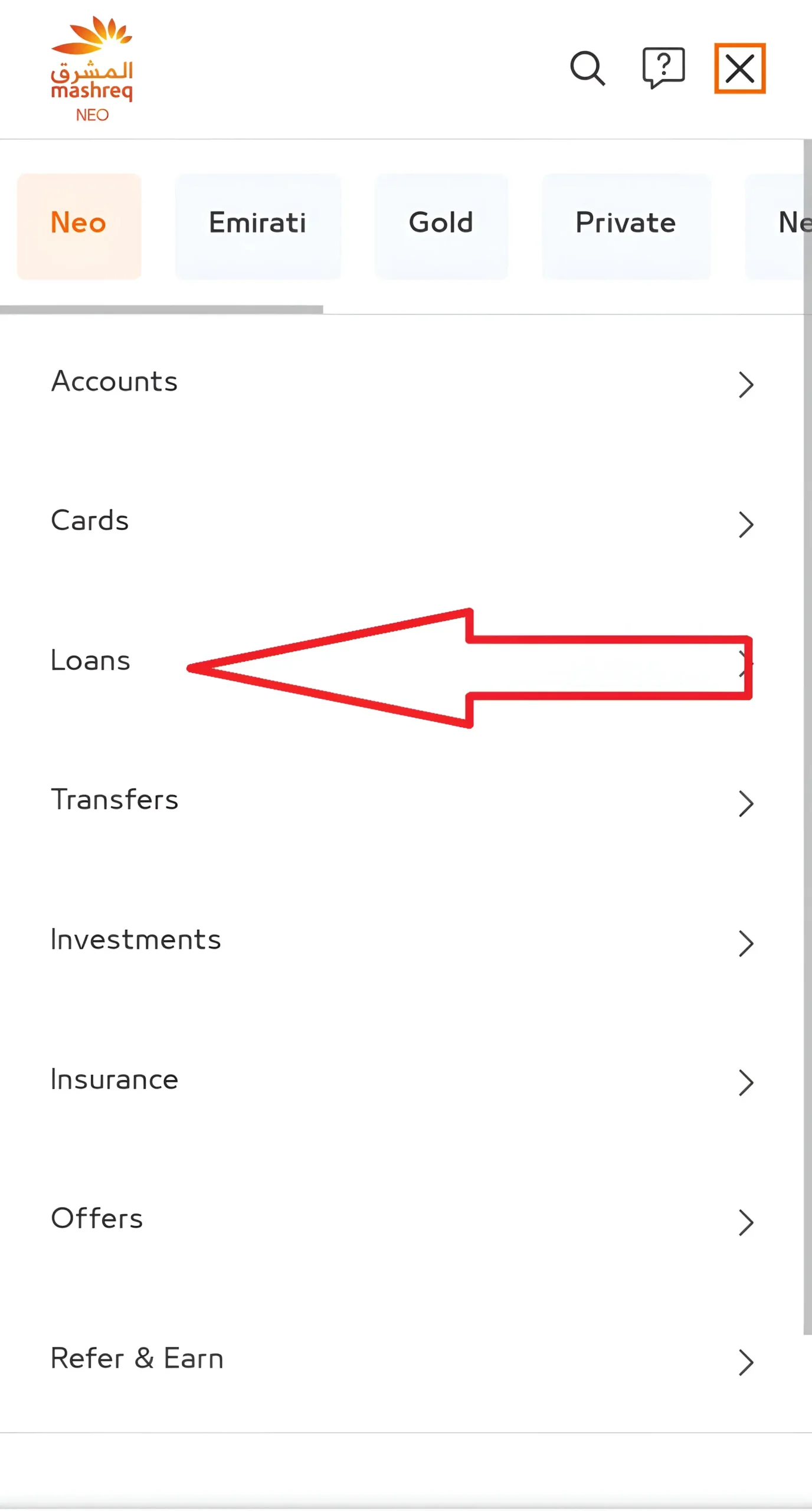

2. Navigate to Personal Loans Section:

- Click on the “Menu” section.

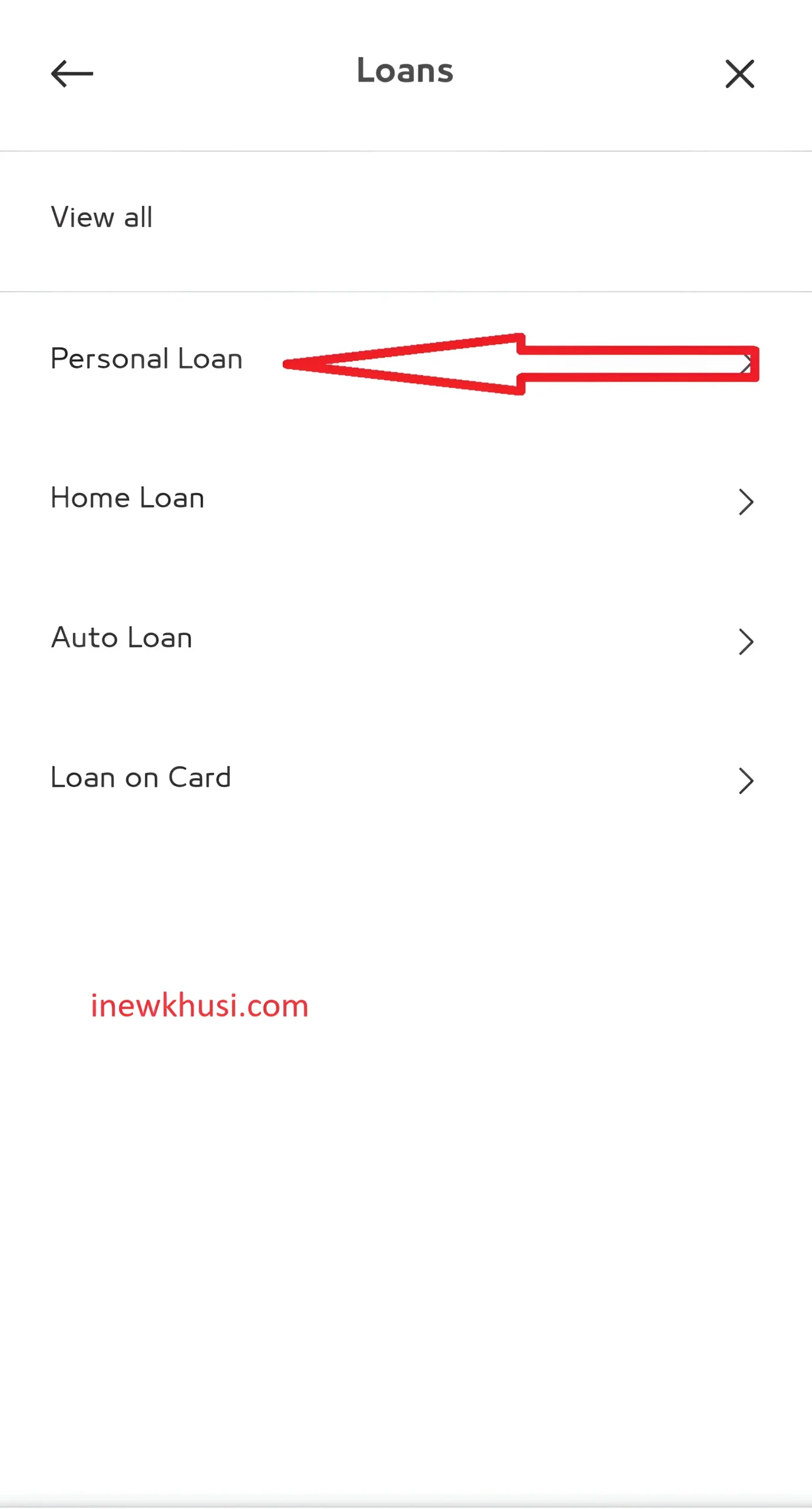

- Click on “Loans”.

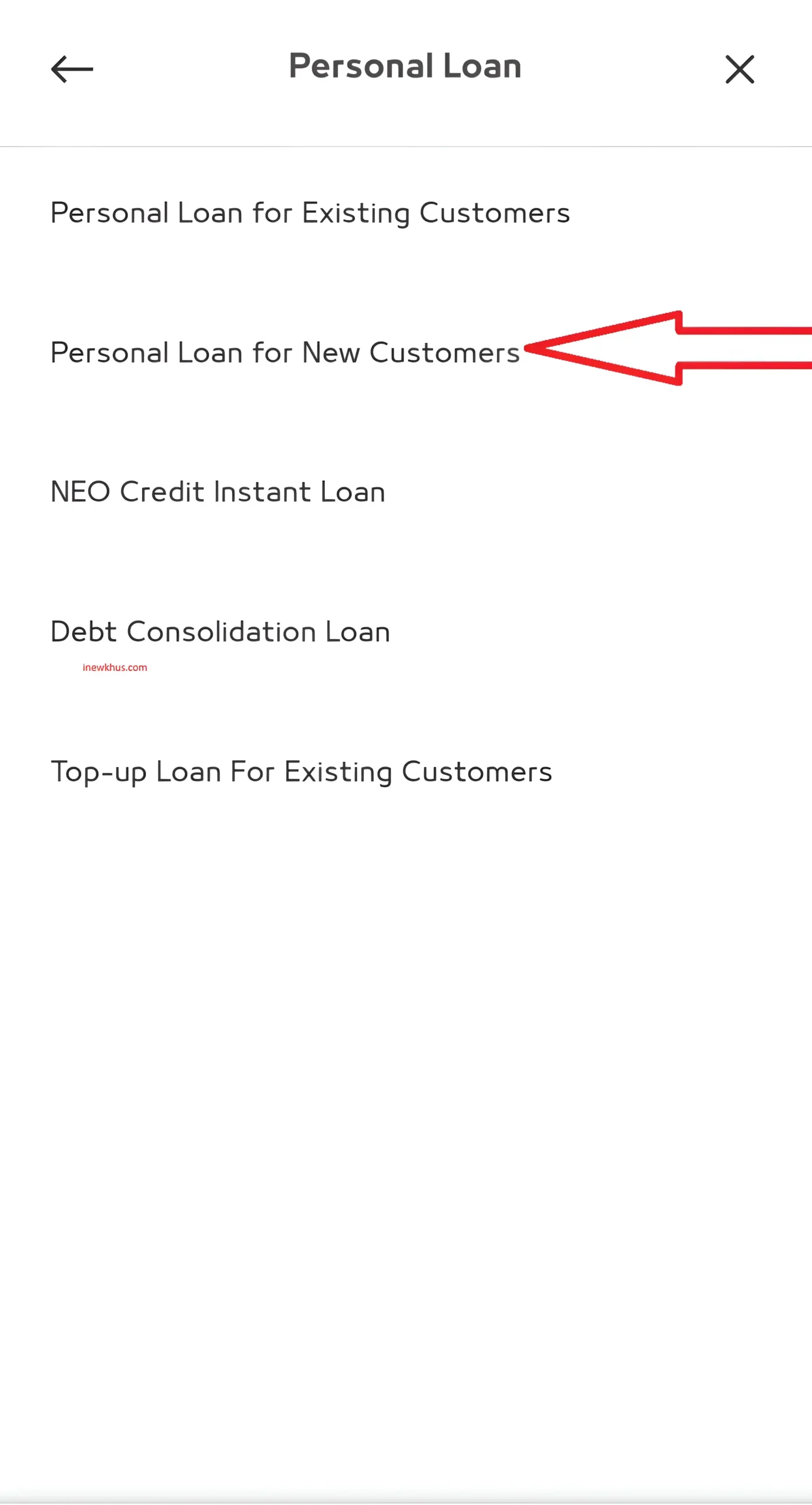

- Choose “Personal Loan”.

- Select “Personal Loan for New Customers”.

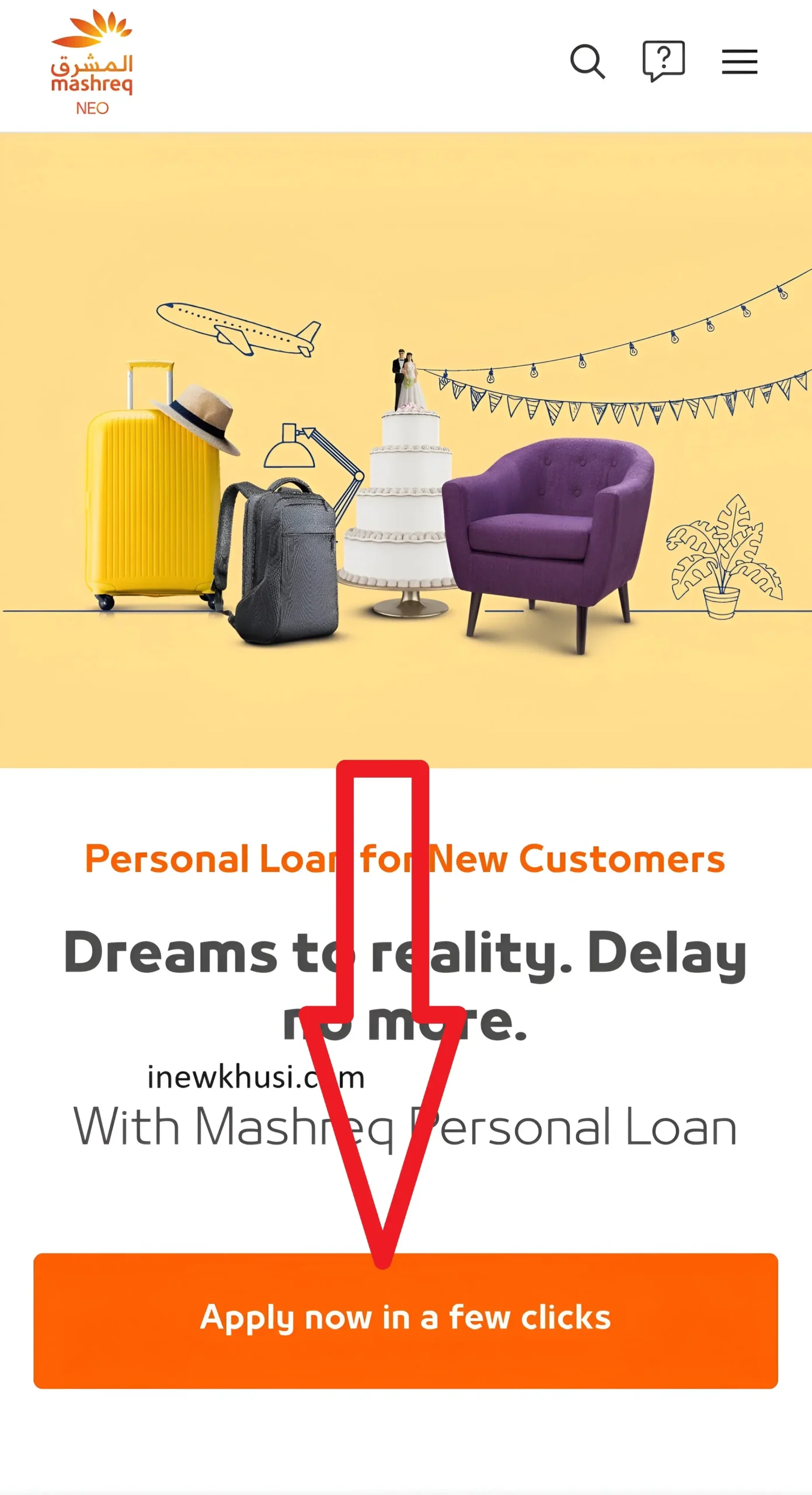

3. Start the Application Process:

- Click on “Apply now in a few clicks”.

- You will see two options: “Get your loan offer in 5 minutes” and “Upload documents”.

- Choose “Get your offer”.

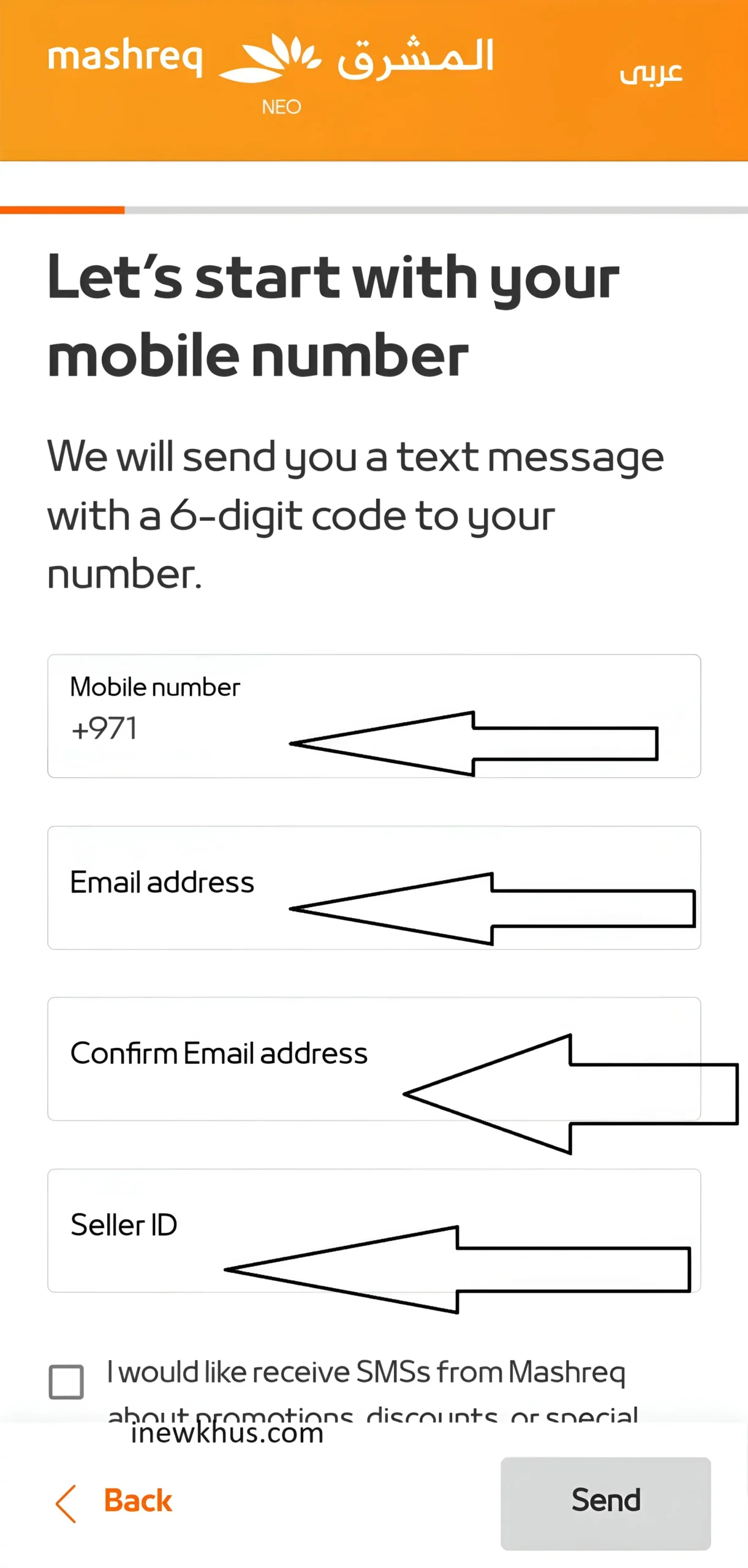

4. Security Details:

- Enter your mobile number (+971).

- Enter your email address and confirm it.

- Enter Seller ID if applicable.

- (Optional) Tick the box to receive SMSs from Mashreq about promotions, discounts, or special offers on new products.

- Click on the option to continue and agree to be contacted for completing the application.

5. Emirates ID Details :

- Upload the front side and back side of your Emirates ID.

6. Identity Verification:

- Allow permission for the camera.

- Click a selfie for verification purposes.

7. Consent:

- Read and allow all terms and conditions.

- Give your consent to proceed.

8. Personal Details:

- Enter your personal details as required.

9. Employment Details :

- Enter your company name.

- Enter your designation.

- Provide the annual turnover of your company.

- Enter your work address (Apartment/Villa No, Building No, Street No/Area, Emirate).

10. Accept Offer :

- Review the loan offer presented to you.

- Accept the offer if you are satisfied with the terms.

11. Next Steps :

- Follow any additional steps or provide any further documentation as requested by Mashreq Bank.

- Complete the application process as guided by the bank’s instructions.

This process ensures you can smoothly apply for a Mashreq Bank Personal Loan for New Customers online.

Mashreq Bank Personal Loan Interest Rates (New Customers)

If you are a new customer of Mashreq Bank, then you will have to pay interest with reduced interest. If you live among Expatriates then the interest starts from 5.99% to 31.99% whereas if you live among Emiratis then the interest starts from 5.99% to 12.99%.

| Customer Type | Interest Rate Range |

| Expatriates | 5.99% to 31.99% (VAT not applicable) |

| Emiratis | 5.99% to 12.99% (VAT not applicable) |

Personal Loan Emi Calculator

Example

If you are a customer of Mashreq Bank, then I would like to explain this information to you with a small example. The example given here will help you learn how this loan actually works out, assuming you get a loan of AED 15,000 for a 14 month term and the interest rate is 4.2%.

| Parameter | Details |

|---|---|

| Loan Amount | AED 15,000 |

| Interest Rate | 4.2% |

| Payback Period | 14 months |

| Monthly Installment | AED 1,100 |

Mashreq Offer

| Payment Year | Monthly Installment (AED) | Principal (AED) | Interest (AED) | Remaining balance (AED) |

| 2024 | 1,100 | 6,340 | 260 | 8,661 |

| 2025 | 1,100 | 8,663 | 137 | 0 |

Loan Offer Pdf : Mashreq Bank Loan Offer For New Customer PDF

Fees And Charges

If you are a new customer of Mashreq Bank, then you should know what fees and charges will be levied on taking a personal loan.

| Fee Type | Amount |

|---|---|

| Processing Fees | 1.05% of the loan amount |

| Loan Top Up Processing Fee | 1.05% of the loan amount |

| Life Insurance Fee for Expatriates | Free coverage |

| Life Insurance Fee for Emiratis | Free coverage |

| Life Insurance Fee for Emiratis – Debt Consolidation Loan | 0.01911% of the outstanding loan amount per month |

| Postponement Fees | AED 105 per postponement |

| Late Payment Fee | 2% of the delayed amount |

| Minimum | AED 52.50 |

| Early Settlement Fee | 1.05% of settled amount or AED 10,500, whichever is lower |

| Temporary/Permanent Release / Clearance Letter | Turnaround time 7 working days |

| Liability Letter Addressed to Other Bank | Turnaround time 7 working days, AED 63 |

| Change of Number Plate | N/A |

| Change of Due Date on Standing Instruction | NIL |

| Change of PDC / Recovery Account | NIL |

| Loan Rescheduling Fee | AED 262.50 |

| Loan Cancellation Fee | AED 105 |

| Other (Loan copy, Issuing redemption statement, audit confirmation, etc.) | AED 26.25 |

Loan Amount

You can get a personal loan from Mashreq Bank up to 20 times your salary, the maximum loan can be taken here up to one million dirhams. Information about how much loan you will be able to take from here is given in the table below, which is as follows:

| Parameter | Details |

|---|---|

| Maximum Loan Amount | AED 1 million |

| Salary Multiple | Up to 20 times your monthly salary |

Loan Tenure

If you are a new customer of Mashreq Bank, then you can avail the loan from here for 3 months to 60 months. You will get this loan directly in your bank account for which you will have to complete the online process. The main information about this loan is as follows:

| Parameter | Details |

|---|---|

| Minimum Tenure | 3 months |

| Maximum Tenure | 60 months (5 years) |

What should you keep in mind while taking Mashreq Bank Loan?

When applying for a personal loan from Mashreq Bank, it’s important to keep the following points in mind:

1. Loan Amount and Interest Rate :

- Understand the loan amount and the applicable interest rate thoroughly. Higher interest rates mean you’ll repay more.

- Interest rates are lower for Emiratis (5.99% to 12.99%) and slightly higher for expatriates (5.99% to 31.99%).

2. EMI and Tenure :

- Understand your monthly EMI and loan tenure well. Choose EMI and tenure that fit within your budget.

- There’s an option to defer the first EMI for up to 90 days.

3. Fees and Charges:

- Understand fees such as processing fees, early settlement fees, postponement fees, and late payment fees.

- The processing fee is 1.05%, and the early settlement fee is also 1.05% or AED 10,500 (whichever is lower).

4. Eligibility Criteria:

- Pay attention to the loan eligibility criteria. Apply considering your salary and employment status.

- Minimum salary requirements are AED 5,000 for approved companies and AED 10,000 for unapproved companies.

5. Documentation:

- Keep necessary documents ready such as Emirates ID, salary certificate, and bank statements.

- You’ll need to submit a valid Emirates ID, salary transfer letter, and bank statements (last 3 months).

6. Insurance Coverage:

- Understand the life insurance coverage provided. Both expatriates and Emiratis receive free coverage.

7. Loan Use:

- Plan how you will use the loan. Use it for appropriate purposes like debt consolidation, home improvement, education, etc.

8. Repayment Capability:

- Understand your repayment capability. Plan to repay monthly installments on time to avoid late payment fees and penalties.

9. Terms and Conditions:

- Read and understand the loan’s terms and conditions carefully. Contact the bank directly for any clarifications or doubts.

10. Financial Planning:

- Conduct financial planning before taking the loan. Apply for the loan considering your income and expenses to avoid future financial burdens.

By keeping these points in mind, you can apply for a personal loan from Mashreq Bank and achieve your financial goals effectively.

Mashreq Bank Personal Loan for New Customers – Customer Support

If you are taking a personal loan from Mashreq Bank and you are its new customer, then this bank provides you with various types of customer support which are as follows:

1. Mashreq Bank Customer Care:

- Phone Number: 04-4244444 (Dubai)

- You can use the 24×7 customer care service for any questions or assistance.

2. Email Support:

- You can also email your queries and complaints.

- Email ID: [customercare@mashreq.com](mailto:customercare@mashreq.com)

3. Branch Visit :

- Visit any nearby Mashreq Bank branch to resolve your queries.

- Use the branch locator on the Mashreq Bank website for details.

4. Online Banking Support :

- Submit your loan-related queries online using the Mashreq Bank website or mobile app.

- Website: [www.mashreqbank.com](https://www.mashreqbank.com)

5. Live Chat Support:

- Utilize the live chat support option available on the Mashreq Bank website to get immediate resolution of your queries.

6. Social Media:

- Post your queries on Mashreq Bank’s social media handles and seek assistance from customer support.

- Facebook: MashreqBank Social FB

- Twitter : @MashreqTweets Social Twitter

By using these services, you can promptly address your loan-related queries. Mashreq Bank’s customer support team is available 24×7 to assist you.

Frequently asked questions (FAQs) Mashreq Personal Loans for New Customers

1. What can I use a Mashreq Personal Loan for?

You can use the loan for education, holiday planning, home renovation, or any other personal financial needs.

2. Do I need to transfer my salary to get a Mashreq Personal Loan?

Yes, transferring your salary to a Mashreq Bank account is a requirement.

3. What are the basic eligibility criteria to get a Mashreq Personal Loan?

You must be a UAE resident, at least 21 years old, with a minimum monthly salary of AED 5,000 (for approved companies) or AED 10,000 (for unapproved companies), and willing to transfer your salary to Mashreq.

4. Can I get a loan if I am an unconfirmed employee?

No, you need to be a confirmed employee or have a minimum of 6 months of service at your current company.

5. With a Mashreq Personal Loan, how much can I borrow?

You can borrow up to 20 times your salary, with a maximum limit of AED 1 million.

6. What are the upfront costs associated with getting a personal loan?

Upfront costs may include processing fees and any applicable interest charges. Specific details should be confirmed with Mashreq Bank.

7. What are the minimum and maximum tenure for a Mashreq Personal Loan?

The loan tenure can range from 3 Months to 60 months, depending on the loan amount and your repayment capacity.

8. Where will proceeds of my Mashreq Personal Loan be credited?

The loan amount will be credited to your Mashreq Bank account.

9. How do I apply for a Mashreq Personal Loan?

You can apply online via the Mashreq Bank website by filling out the application form and uploading the required documents.

10. What is a salary transfer letter?

It is a letter issued by your employer stating your Mashreq salary transfer account number and confirming the transfer of your salary to Mashreq until the loan is fully repaid.

11. What is a security cheque?

A security cheque is a Mashreq-issued cheque, filled out with the loan amount in words and digits, signed, and payable to Mashreq Bank, left undated.

12. How do I calculate my EMI?

You can use the EMI calculator on my website by entering the loan amount, tenure, and interest rate to estimate your monthly repayments.

13. What happens if I miss an EMI payment?

Missing an EMI payment may result in late fees, additional interest charges, and a negative impact on your credit score. It’s important to contact the bank to discuss options if you anticipate missing a payment.

14 . How can I check the status of my loan application?

You can check the status of your application online through the Mashreq Bank website or by contacting Mashreq Bank customer service.

Final Words

Mashreq Bank Personal Loan for New Customers is an excellent option that helps you fulfill your personal financial needs. You can use this loan for purposes like debt consolidation, home improvements, education, wedding expenses, travel, medical expenses, vehicle purchase, business ventures, and emergencies.

If you have any doubts or confusion, Mashreq Bank’s customer support team is available 24×7 to assist you. Always ensure to consider your repayment capabilities when taking a loan and be financially responsible.

This information will assist you in making the right decision for your loan and help you achieve your financial goals.